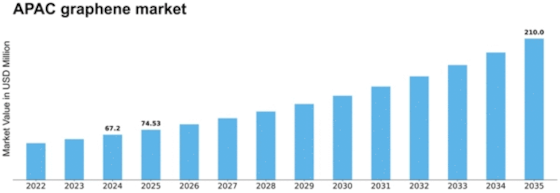

Asia Pacific Graphene Size

Asia Pacific Graphene Market Growth Projections and Opportunities

The Asia Pacific Graphene Market is shaped by a multitude of market factors contributing to its growth and development. A significant driver is the region's emphasis on technological innovation and research and development. Asia Pacific countries, particularly China and South Korea, have been at the forefront of graphene research, exploring its potential applications in various industries. As a result, the region has become a key player in the global graphene market, with continuous efforts to harness the unique properties of graphene for advancements in electronics, energy storage, and materials science.

Government initiatives and funding play a crucial role in propelling the Asia Pacific Graphene Market forward. Governments across the region have recognized the strategic importance of graphene in driving innovation and economic development. Funding programs and initiatives supporting graphene research and commercialization have been implemented to accelerate the translation of research findings into practical applications. The collaboration between governments, research institutions, and industry stakeholders fosters an environment conducive to the growth of the graphene market in Asia Pacific.

The electronics and semiconductor industries are pivotal drivers for the adoption of graphene in the Asia Pacific region. Graphene's exceptional electrical conductivity and thermal properties make it an attractive material for applications in electronics, such as transistors, sensors, and flexible displays. The continuous demand for smaller, faster, and more efficient electronic devices in Asia Pacific countries drives the exploration and integration of graphene-based solutions, positioning the region as a major contributor to the global graphene market in the electronics sector.

Market factors related to energy storage technologies significantly influence the Asia Pacific Graphene Market. With the increasing focus on renewable energy sources and the development of energy storage solutions, graphene's use in batteries and supercapacitors gains prominence. The superior conductivity and high surface area of graphene contribute to enhanced energy storage capacity and faster charging times. As Asia Pacific nations actively invest in clean energy technologies, the demand for graphene in energy storage applications is expected to grow, shaping the dynamics of the regional graphene market.

Environmental considerations and sustainability also play a role in influencing the Asia Pacific Graphene Market. The material's potential applications in water purification, environmental monitoring, and eco-friendly technologies align with the region's commitment to sustainable development. Researchers and industries in Asia Pacific explore graphene's role in addressing environmental challenges, contributing to a more sustainable and environmentally conscious market.

Market competition and industry collaborations are notable factors in the Asia Pacific Graphene Market. The region features a mix of established companies and startups, fostering a competitive landscape. Collaborations and partnerships between graphene producers, research institutions, and end-users facilitate the development of practical applications and enhance the commercialization prospects of graphene-based products. The collaborative efforts contribute to the overall growth and maturity of the graphene market in Asia Pacific.

The impact of global economic conditions and trade dynamics is evident in the Asia Pacific Graphene Market. As a globally traded commodity, market participants in the region closely monitor international developments, trade agreements, and geopolitical factors that may impact the supply chain and market conditions for graphene. Economic stability and trade policies play a role in determining the accessibility of graphene materials and their cost in the Asia Pacific market.

Challenges related to standardization, large-scale production, and cost-effectiveness are factors that the graphene industry in Asia Pacific addresses. While graphene exhibits exceptional properties at the nanoscale, achieving scalable and cost-effective production methods is an ongoing challenge. The development of standardized processes and the integration of graphene into commercial products at an economically viable scale are crucial for the widespread adoption of graphene in various industries in the Asia Pacific region.

Leave a Comment