Market Trends

Key Emerging Trends in the Asia Pacific Automotive Lubricants Market

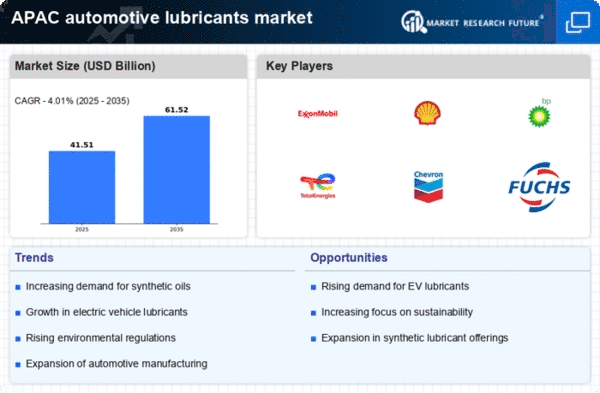

The Asia Pacific automotive lubricants market has been showing strong trends, reflecting the stronger automotive industry in the region. The growing automobile industry is driving demand for premium performance lubricants. The demand for cutting-edge lubricants that boost motor productivity and lifespan is rising as China, India, and Japan produce and sell more cars.

Asia Pacific market trends are also influenced by environmental concerns. A shift toward eco-friendly lubricants is evident as reasonable practices and administrative procedures reduce fossil fuel byproducts. Due to the automotive industry's focus on contamination, makers are increasingly making bio-based and tailored lubricants.

In addition, the automotive industry's rapid transformation has caused another lubricants market shift. Innovative car technologies, such as electric and cross-breed vehicles, have led to the development of lubricants designed for these high-level systems. Electric vehicles require lubricants that can handle their unique drivetrain and battery requirements, creating another market niche.

Asia Pacific's competitive automotive lubricants market is also changing. Competition from global and regional players drives companies to focus on product development and critical coordinated initiatives. Grease companies are adding lubricants for diverse vehicle kinds and purposes to their product lines.

Online company boom in the area has also affected market factors. Web-based buying has made lubricants more accessible, changing delivery channels. Online business platforms have been popular for buying automotive lubricants, offering convenience and many products.

Government policies shape Asia Pacific automotive lubricants market trends. Quality lubricants that improve engine performance and reduce environmental impact are being accepted due to strict emission standards. Manufacturers are adapting their product development methods to these criteria to stay competitive and meet consumer demands.

Leave a Comment