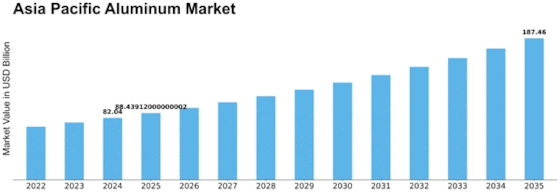

Asia Pacific Aluminum Size

Asia Pacific Aluminum Market Growth Projections and Opportunities

There are many things that determine the dynamics and growth of the Aluminum Market in Asia-Pacific. A leading factor among these is the ever-increasing rate of industrialization and urbanization in many countries within this region. Infrastructure construction projects and development have caused a tremendous demand for aluminum with use ranging from building and construction, transportation to packaging among others. For instance, the lightweight nature coupled with anti-corrosion property has made aluminum to be a favorite material in such sectors driving its overall demand in the whole region.

Regulations by governments also shape the Asia Pacific Aluminum Market very much because environmental regulations influence aluminum industry production processes as well as emission standards. Given most countries sustainability drives and need to preserve its environment, there is growing emphasis on use of cleaner technologies that are energy efficient when it comes to manufacturing aluminum products. The increased desire for green policies has also led to advancement in technology usage as well seeking more alternative ways of power generation during production process` of aluminum.

Asia Pacific Aluminium market is impacted by worldwide trading and economic conditions as well. This area is a key player in international trade thus factors like tariffs, trade agreements, geopolitical tensions can all influence raw material costs, affect market competition or even impact on overall aluminium product supply chain. Economic stability plus currency exchange rate fluctuation also adds further volatility in these markets thereby influencing decisions regarding investment as well as pricing strategies applied by aluminium manufacturers or producers who are based within Asia.

Consumer preferences and trends are changing affecting how much people buy aluminium products across Asian pacific area, especially those sold into automobile industry so that they can help make cars lighter hence improve fuel efficiency while cutting down pollution levels at same time through reduced emissions. Additionally, due to their weight-to-strength ratio being favourable light vehicles have turned out be very popular amongst them which increases aluminum manufacture. Moreover, due to its recyclability aluminium materials seem to be increasingly demanded by those consumers who are keen on using sustainable ones.

The Asia Pacific Aluminium Market is significantly influenced by technological advances and research in the aluminum industry. The use of advanced manufacturing techniques has resulted in better production processes, new alloy formulations and end-products made from aluminum. As technology continues to advance there are new emerging applications for aluminum which increase both its quality and performance as a metal. Such technologies are vital for maintaining competitiveness within the market as the needs of different industries also change.

Raw materials availability, energy costs and transportation logistics are all supply chain issues that shape the Asia Pacific Aluminum Market. Bauxite extraction which is the main raw material for making aluminium has to consider environmental as well as social impacts associated with it. Furthermore, electricity cost has a significant impact on overall cost structure for aluminium manufacturers because it represents such a large portion of total expenditures during production process. In Asia-Pacific, a reliable supply chain is crucial to guaranteeing an affordable market price thus sustainability of aluminum.”

Leave a Comment