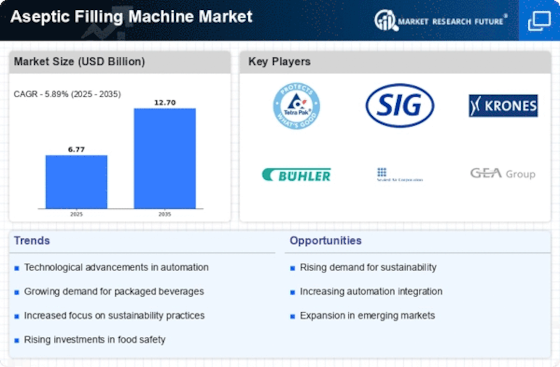

Growth of the Dairy and Beverage Industries

The Aseptic Filling Machine Market is witnessing substantial growth driven by the expansion of the dairy and beverage industries. With an increasing consumer preference for dairy products and ready-to-drink beverages, manufacturers are seeking efficient filling solutions to meet this demand. The dairy sector, in particular, is projected to grow at a rate of 4% annually, necessitating the adoption of aseptic filling technologies to ensure product longevity and safety. Aseptic filling machines enable the packaging of these products without preservatives, appealing to health-conscious consumers. This trend is likely to continue, as the beverage industry also embraces aseptic technology to enhance product shelf life and reduce spoilage. Consequently, the Aseptic Filling Machine Market is expected to thrive as these sectors expand.

Increasing Focus on Food Safety Regulations

The Aseptic Filling Machine Market is significantly influenced by the increasing focus on food safety regulations. Governments and regulatory bodies are implementing stringent guidelines to ensure the safety and quality of food products. This regulatory environment compels manufacturers to adopt aseptic filling technologies that comply with these standards. The demand for machines that can effectively eliminate microbial contamination is on the rise, as companies seek to avoid costly recalls and maintain consumer trust. Recent reports indicate that the food safety equipment market is expected to grow at a rate of 6% per year, reflecting the urgency for compliance. As a result, the Aseptic Filling Machine Market is likely to benefit from this heightened emphasis on safety, driving further investments in advanced filling technologies.

Technological Innovations in Aseptic Filling

Technological advancements are significantly shaping the Aseptic Filling Machine Market. Innovations such as automated systems, real-time monitoring, and enhanced sterilization techniques are being integrated into aseptic filling machines. These advancements not only improve efficiency but also ensure higher levels of product safety and quality. For instance, the introduction of smart sensors and IoT capabilities allows for better tracking and management of the filling process. As a result, manufacturers can optimize their operations, reduce waste, and enhance overall productivity. The market for these advanced machines is expected to expand, with estimates suggesting a growth rate of around 5% annually. This continuous evolution in technology is likely to attract more players into the Aseptic Filling Machine Market, fostering a competitive landscape.

Rising Demand for Packaged Food and Beverages

The Aseptic Filling Machine Market is experiencing a notable surge in demand for packaged food and beverages. This trend is driven by changing consumer lifestyles, which increasingly favor convenience and longer shelf life. According to recent data, the packaged food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. Aseptic filling technology plays a crucial role in this growth, as it allows for the preservation of food quality without the need for refrigeration. Consequently, manufacturers are investing in advanced aseptic filling machines to meet this rising demand, thereby enhancing their production capabilities and ensuring product safety. This shift towards packaged goods is likely to continue, further propelling the Aseptic Filling Machine Market.

Sustainability and Eco-Friendly Packaging Initiatives

Sustainability is becoming a pivotal driver in the Aseptic Filling Machine Market. As consumers increasingly demand eco-friendly packaging solutions, manufacturers are responding by adopting sustainable practices in their production processes. Aseptic filling technology allows for the use of recyclable materials and reduces the carbon footprint associated with food packaging. Recent studies indicate that the market for sustainable packaging is anticipated to grow by 7% annually, reflecting a shift towards environmentally responsible practices. Companies are investing in aseptic filling machines that not only meet safety standards but also align with sustainability goals. This dual focus on safety and environmental impact is likely to enhance the appeal of the Aseptic Filling Machine Market, attracting both consumers and investors.