Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure are significantly influencing the Cardiovascular Information System Market. Various countries are investing in healthcare technology to enhance patient care and reduce healthcare costs. For example, funding programs for health IT systems are being implemented to encourage the adoption of electronic health records and cardiovascular information systems. This financial support is likely to accelerate the development and deployment of innovative solutions within the market. As a result, the Cardiovascular Information System Market is expected to benefit from these initiatives, leading to increased accessibility and improved health outcomes for patients with cardiovascular diseases.

Focus on Data Security and Compliance

Data security and compliance are becoming paramount in the Cardiovascular Information System Market. With the increasing digitization of health records, ensuring the protection of sensitive patient information is critical. Regulatory frameworks, such as HIPAA, mandate strict compliance measures for healthcare providers, driving the need for secure information systems. As organizations prioritize data security, the demand for advanced cybersecurity solutions within cardiovascular information systems is expected to rise. This focus on compliance and security may lead to innovations in the market, as companies strive to develop systems that not only meet regulatory requirements but also enhance patient trust and safety.

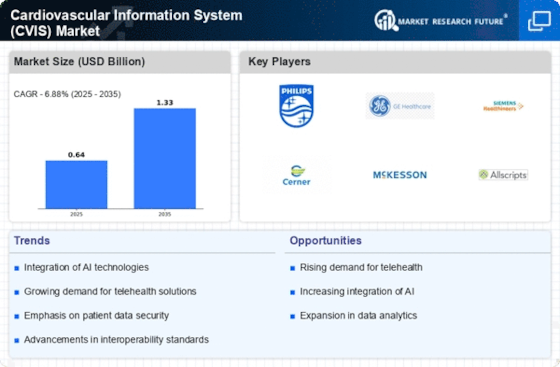

Technological Advancements in Healthcare

Technological innovations are transforming the landscape of the Cardiovascular Information System Market. The integration of artificial intelligence, machine learning, and telemedicine into cardiovascular care is enhancing diagnostic accuracy and treatment efficacy. For instance, AI algorithms can analyze vast amounts of patient data to identify risk factors and predict outcomes, which is becoming increasingly essential in clinical settings. The market is projected to witness substantial growth as healthcare facilities adopt these advanced technologies to streamline operations and improve patient care. This trend suggests that the Cardiovascular Information System Market will continue to evolve, driven by the need for more sophisticated and efficient healthcare solutions.

Growing Demand for Remote Patient Monitoring

The demand for remote patient monitoring solutions is driving growth in the Cardiovascular Information System Market. As healthcare shifts towards more patient-centered approaches, the ability to monitor patients outside traditional clinical settings is becoming crucial. Remote monitoring technologies allow healthcare providers to track patients' cardiovascular health in real-time, facilitating timely interventions and reducing hospital readmissions. This trend is particularly relevant as patients increasingly prefer to manage their health from home. The Cardiovascular Information System Market is likely to expand as more healthcare organizations adopt these solutions to enhance patient engagement and improve overall care delivery.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases is a primary driver for the Cardiovascular Information System Market. As populations age and lifestyle-related health issues become more prevalent, the demand for effective management solutions rises. According to recent statistics, cardiovascular diseases account for a significant portion of global mortality rates, necessitating advanced information systems for monitoring and treatment. This trend indicates a growing need for integrated systems that can provide real-time data and analytics, thereby enhancing patient outcomes. The Cardiovascular Information System Market is likely to expand as healthcare providers seek to implement these technologies to address the rising burden of cardiovascular conditions.