Rising Prevalence of Corneal Diseases

The increasing incidence of corneal diseases is a critical driver for the Artificial Cornea Implant Market. Conditions such as keratoconus, corneal dystrophies, and traumatic injuries are becoming more prevalent, necessitating effective treatment options. According to recent data, corneal blindness affects millions worldwide, creating a substantial demand for artificial cornea solutions. This rising prevalence is prompting healthcare systems to invest in advanced treatment modalities, including artificial corneas, to address the growing patient population. As awareness of these conditions increases, the market is expected to witness a corresponding rise in demand for artificial cornea implants.

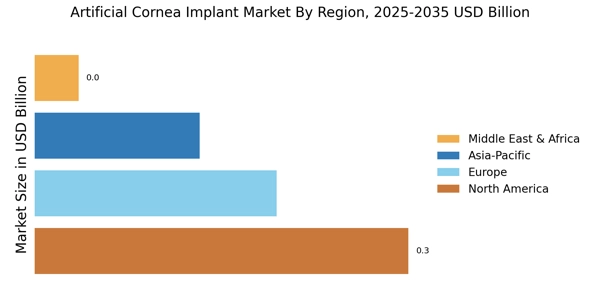

Integration of Digital Health Solutions

The integration of digital health solutions into the Artificial Cornea Implant Market is transforming patient care and management. Telemedicine platforms and mobile health applications are facilitating remote consultations and follow-ups, making it easier for patients to access care. This trend is particularly beneficial for individuals in remote areas who may have limited access to specialized eye care. Furthermore, digital health solutions enable better tracking of patient outcomes and adherence to treatment protocols, which can enhance the overall effectiveness of artificial cornea implants. As these technologies continue to evolve, they are likely to play a pivotal role in shaping the future of the market.

Growing Investment in Research and Development

Investment in research and development is a significant driver for the Artificial Cornea Implant Market. Pharmaceutical companies and research institutions are increasingly focusing on developing innovative solutions to improve corneal health. This includes exploring new biomaterials and surgical techniques that can enhance the performance of artificial corneas. The market is witnessing a rise in funding for clinical trials aimed at evaluating the safety and efficacy of these new products. As R&D efforts yield promising results, they are expected to lead to the introduction of advanced artificial cornea implants, further stimulating market growth.

Increasing Awareness and Education Initiatives

Increasing awareness and education initiatives regarding corneal health are contributing to the growth of the Artificial Cornea Implant Market. Campaigns aimed at educating the public about corneal diseases and available treatment options are gaining traction. These initiatives are often supported by healthcare organizations and non-profits, which are working to disseminate information about the benefits of artificial corneas. As more individuals become informed about their options, the demand for artificial cornea implants is likely to rise. This heightened awareness is essential for driving market growth and ensuring that patients seek timely interventions for corneal conditions.

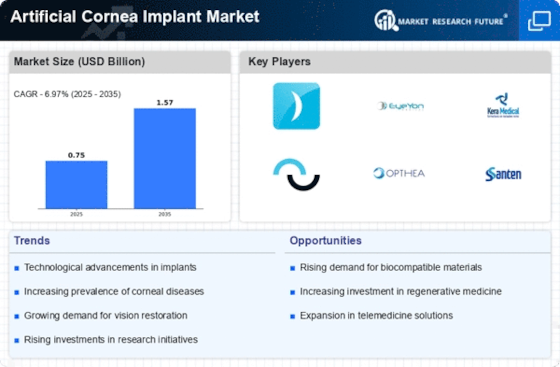

Technological Advancements in Artificial Cornea Implant Market

The Artificial Cornea Implant Market is experiencing a surge in technological advancements that enhance the efficacy and safety of corneal implants. Innovations such as bioengineered corneas and advanced materials are being developed to mimic the natural cornea more closely. These advancements not only improve visual outcomes but also reduce the risk of rejection and complications associated with traditional grafts. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. As these technologies become more accessible, they are likely to drive adoption rates among healthcare providers and patients alike, thereby expanding the overall market.