Rising Mobile Data Consumption

The wireless telecommunication service market in Argentina is experiencing a notable increase in mobile data consumption. As of 2025, mobile data traffic is projected to grow by approximately 40% annually, driven by the proliferation of smartphones and mobile applications. This surge in demand compels service providers to enhance their network capabilities and invest in infrastructure improvements. Consequently, the competition among operators intensifies, leading to innovative pricing strategies and service offerings. The growing reliance on mobile data for various applications, including streaming services and social media, further propels this trend. As consumers increasingly seek high-speed connectivity, the wireless telecommunication-service market must adapt to meet these evolving demands, ensuring that users have access to reliable and efficient services.

Regulatory Changes and Policy Support

Regulatory changes and policy support are crucial factors influencing the wireless telecommunication-service market in Argentina. The government is actively working to create a favorable regulatory environment that encourages investment in telecommunications infrastructure. Recent policy initiatives aim to streamline licensing processes and reduce barriers to entry for new operators. As of 2025, these efforts are expected to result in increased investment in network expansion and modernization, particularly in underserved areas. The wireless telecommunication-service market stands to benefit from enhanced connectivity and improved service availability, ultimately contributing to economic growth. Furthermore, regulatory support for innovation and competition is likely to stimulate advancements in technology and service delivery, positioning the market for sustained growth in the coming years.

Growing Demand for Mobile Financial Services

The wireless telecommunication-service market in Argentina is witnessing a significant rise in demand for mobile financial services. With an increasing number of consumers relying on mobile platforms for banking and payment solutions, the market is evolving to accommodate these needs. As of 2025, it is estimated that over 30% of the population will utilize mobile payment applications, reflecting a shift towards digital financial transactions. This trend is further supported by the government's initiatives to promote financial inclusion and digital literacy. Consequently, telecommunications providers are likely to collaborate with financial institutions to offer integrated services, enhancing customer engagement and satisfaction. The growing adoption of mobile financial services is expected to drive revenue growth within the wireless telecommunication-service market, as operators seek to capitalize on this emerging opportunity.

Increased Competition Among Service Providers

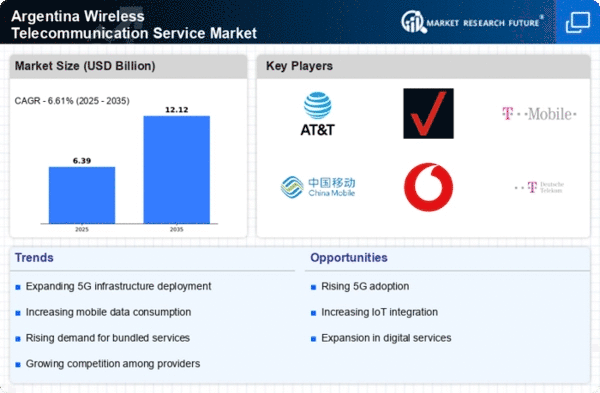

The competitive landscape of the wireless telecommunication-service market in Argentina is intensifying, with multiple players vying for market share. As of November 2025, the market comprises several established operators and new entrants, each striving to differentiate their offerings. This heightened competition is likely to lead to aggressive pricing strategies, promotional campaigns, and enhanced service quality. Consumers benefit from this rivalry, as they gain access to a wider array of services and better pricing options. Additionally, operators may invest in customer retention strategies, such as loyalty programs and personalized services, to maintain their subscriber base. The dynamic nature of competition within the wireless telecommunication-service market is expected to foster innovation and drive overall market growth.

Technological Advancements in Network Infrastructure

Technological advancements play a pivotal role in shaping The wireless telecommunication service market in Argentina. The ongoing development of advanced network technologies, such as 5G and beyond, is expected to revolutionize the telecommunications landscape. By 2025, it is anticipated that 5G networks will cover over 60% of the urban population, facilitating faster data speeds and lower latency. This shift not only enhances user experience but also enables new applications, such as IoT and smart city initiatives. As operators invest in upgrading their infrastructure, the wireless telecommunication-service market is likely to witness increased competition, driving innovation and improved service delivery. The integration of cutting-edge technologies will be crucial for operators aiming to maintain a competitive edge in this dynamic environment.