Argan Oil Size

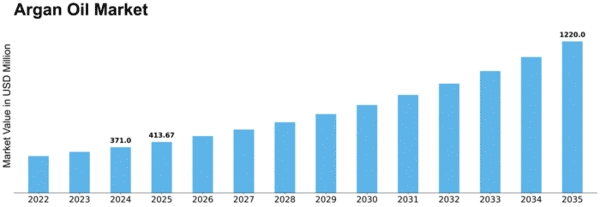

Argan Oil Market Growth Projections and Opportunities

The Argan Oil Market operates inside the realm of leading skin care, prompted by various factors that cater to the developing demand for natural and top-rate cosmetic merchandise. A primary driving force propelling this market is the increasing recognition amongst consumers about the capacity benefits of Argan Oil for skin and hair care. As individuals prioritize easy beauty and are seeking merchandise derived from natural resources, the demand for extremely good Argan Oil stays continuously high. The market responds to various purchaser options, offering a number of Argan Oil products, including pure oils, serums, shampoos, and lotions, offering customers picks that align with their particular wellness desires. Consumer preferences and the clean beauty motion play a pivotal role in shaping the Argan Oil market. With a growing emphasis on ingredient transparency, customers seek skincare and haircare merchandise that excludes dangerous chemical compounds, artificial fragrances, and components. Economic elements drastically impact the Argan Oil market. As consumers emerge as extra conscious of the substances of their leading products and are inclined to invest in top-class and natural skincare solutions, they will select Argan Oil products over conventional alternatives. The market's increase is encouraged by the financial feasibility of investing in products that align with the values of beauty-aware customers. Additionally, financial downturns may influence spending patterns, emphasizing the importance of supplying a combination of cheap and superb Argan Oil options to deal with various budget issues in the market. In the distribution channel of the manufacturer, dealer, and distributor interactions, the invention of the latest objects and ultimately exporting the product to dominant markets, inclusive of Europe and North America, has multiplied. To make their products available at affordable prices, producers alter their business tactics to encompass import and export. A massive variety of rivals are promoting via their retail locations and have partnered with strong point merchants to improve product sales and market penetration inside the Argan Oil zone. Cultural influences and changing perceptions of beauty and wellness from the Argan Oil market. As societal attitudes closer to natural leading and self-care evolve, manufacturers may additionally adapt their Argan Oil formulations and advertising and marketing strategies to align with changing customer values. Regulatory issues regarding product safety, element labeling, and marketing claims are important in shaping the Argan Oil market. Adherence to regulations guarantees that Argan Oil products meet precise protection requirements, offer accurate statistics to consumers, and align with recognized skincare and beauty requirements. The virtual landscape plays a pivotal position in advertising and accessibility within the Argan Oil market. Online structures, e-trade, and social media function as effective gear for showcasing new Argan Oil products, imparting skincare hints, and facilitating direct conversation among manufacturers and leading fans.

Leave a Comment