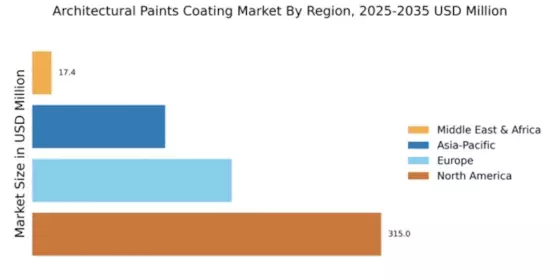

North America : Market Leader in Coatings

North America is poised to maintain its leadership in the architectural paints coating market, holding a significant market share of $315.0 million in 2025. The region's growth is driven by robust construction activities, increasing renovation projects, and a rising demand for eco-friendly products. Regulatory support for sustainable practices further enhances market dynamics, encouraging innovation and investment in advanced coatings technologies.

The competitive landscape in North America is characterized by the presence of major players such as Sherwin-Williams, PPG Industries, and Benjamin Moore. These companies are leveraging their extensive distribution networks and strong brand recognition to capture market share. The U.S. remains the largest market, with Canada and Mexico also contributing to growth through increased infrastructure development and consumer demand for high-quality coatings.

Europe : Sustainable Growth Focus

Europe's architectural paints coating market is projected to reach $180.0 million by 2025, driven by stringent environmental regulations and a growing preference for sustainable products. The region's commitment to reducing carbon emissions and promoting green building practices is a key catalyst for market growth. Additionally, the rise in DIY projects and home renovations is boosting demand for high-quality paints and coatings across various segments.

Leading countries in Europe include Germany, France, and the UK, where major players like AkzoNobel and BASF are actively innovating to meet consumer demands. The competitive landscape is marked by a focus on eco-friendly formulations and advanced technologies. The European market is characterized by a mix of established brands and emerging companies, all striving to capture a share of the growing demand for sustainable architectural coatings.

Asia-Pacific : Rapid Growth Region

The Asia-Pacific architectural paints coating market is expected to reach $120.0 million by 2025, fueled by rapid urbanization and increasing disposable incomes. Countries like China and India are witnessing a construction boom, leading to heightened demand for architectural coatings. Additionally, government initiatives aimed at improving infrastructure and housing are further propelling market growth in the region, making it a key player in the global market landscape.

China stands out as the largest market in the region, with significant contributions from India and Japan. Key players such as Nippon Paint and Asian Paints are focusing on innovation and expanding their product portfolios to cater to diverse consumer needs. The competitive environment is intensifying, with both local and international brands vying for market share, driven by the growing trend of home improvement and renovation projects.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa architectural paints coating market is projected to reach $17.36 million by 2025, driven by increasing construction activities and urban development. The region is witnessing a surge in infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries, which is boosting demand for high-quality architectural coatings. Additionally, the growing trend of sustainable building practices is influencing market dynamics, encouraging the adoption of eco-friendly products.

Leading countries in this region include the UAE and South Africa, where key players are focusing on expanding their presence. Companies are investing in innovative solutions to meet the rising demand for durable and aesthetically pleasing coatings. The competitive landscape is evolving, with both local and international brands striving to establish a foothold in this emerging market, driven by the need for modernization and urbanization.