Applied Ai Size

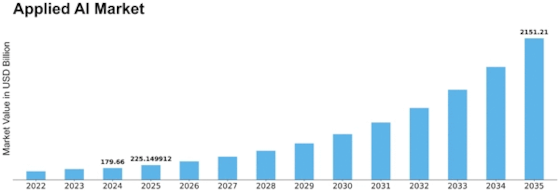

Applied AI Market Growth Projections and Opportunities

The market dynamics of Applied AI are complex and these reflect the profound impact of AI technologies across diverse industries. Among the many areas where it is applicable, machine learning and natural language processing to computer vision and predictive analytics are some examples of applied AI. This dynamic nature of the Applied AI market is manifested by several key drivers which show that innovation, efficiency, and problem-solving transformation solutions drive this industry. One major driver that shapes the market dynamics of Applied AI is the continual push for automation and productivity gains in different sectors. By automating repetitive and labor-intensive tasks, artificial intelligence (AI) technologies enhance productivity while at the same time reducing costs. For instance, AI has become useful in such fields as manufacturing, logistics, customer service or data analysis among others because they allow humans to concentrate on other strategic aspects of their work which requires more brain power unlike repeating tasks without much thinking involved. Widespread adoption of applied artificial intelligence can be attributed to improved operational efficiency in various industries.

Moreover, the demand for personalized experiences and services significantly influences the market dynamics of Applied AI. Personal assistants as well as recommendation engines analyze user behavior thus ensuring user-centered experiences are achieved through customization. The likes ecommerce, streaming services or marketing benefit from a personalization approach driven by artificial intelligence hence better results can be achieved when it comes to interaction with prospects, retention rate as well as overall brand loyalty. Therefore, with such advanced technology like artificial intelligence systems understanding individual preferences leading to custom interactions; consumers’ expectations for personalized real-time encounters have been addressed.

This dynamic environment within the applied AI landscape includes providers offering specialized industry-specific platforms or general-purpose software tools amongst other differentiated solutions. Specialized applications, scalability issues related to particular ML algorithms used for modeling purposes including interpretability concerns around why certain decisions were made make up a large part differentiation among providers in this market space; addition is integration capabilities too whereby specific platforms may give room for third parties who expand functionalities. Innovations in AI are spurred by competition among AI providers who aim to develop solutions that enhance efficiency, insights, and overall operational performance across industries.

Applied AI’s market dynamics are influenced by interoperability with existing systems and seamless integration with various technologies. There is a wide range of software, hardware, and data infrastructures within organizations. For this reason, applications which can be integrated into the existing workflow making it easier to adopt should be recommended among others features like interoperability. In this way, businesses can continue using their current technology investments while adding AI applications that boost their ability as companies.

Leave a Comment