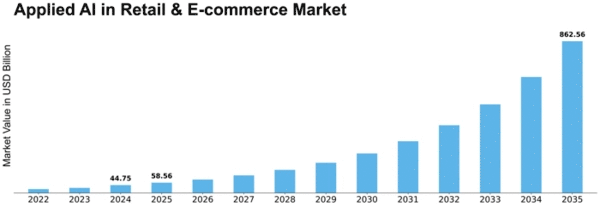

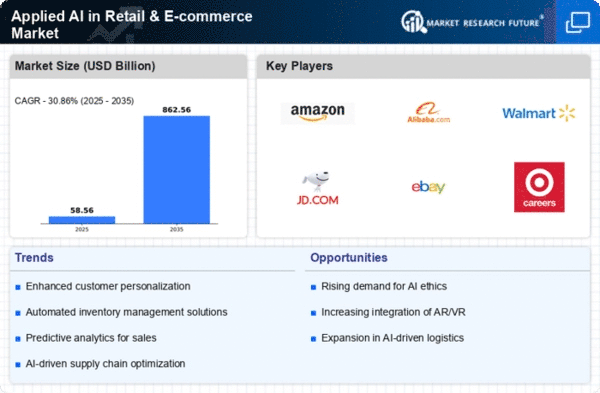

Applied Ai In Retail E Commerce Size

Applied AI in Retail & E-commerce Market Growth Projections and Opportunities

The first driver that shapes the market dynamics of Applied AI in Retail and E-commerce is personalized customer experiences. Personalized product recommendations carry out via AI algorithms using customer data from browsing behaviors to historical purchase patterns while targeted marketing campaigns are facilitated by individualized promotions. Enhanced understanding of customers' preferences by AI results into better engagement with clients hence boosting conversion rates leading to loyalty development. Seamless shopping journey that is also personalizable has been one major force driving adoption of artificial intelligence on retail/e-commerce platforms. The industry’s acceleration towards superior customer experiences delivered through AI-driven technologies, improved operational efficiency and the transformative power of Artificial Intelligence shape the market dynamics of Applied AI in Retail and E-commerce. In Retail and E-commerce, Applied AI covers a wide range of applications like personalized recommendations, supply chain optimization, demand forecasting and customer service automation. Several key drivers contribute to the dynamic nature of this market, reflecting the evolving landscape of retail and the imperative for innovation in an increasingly digital and competitive environment.

Applied AI in Retail: Market Dynamics – e-Commerce evolution and online purchasing influencing factors. For instance with more consumers turning to online platform for their purchases, there have been new developments such as virtual try-ons which aid in visual search as well as interactive shopping. Simplifying buying process online, product discovery improvement or provision of virtual assistance services are some other areas where artificial intelligence technologies are employed here. This helps them meet growing demands for digital-savvy customers but also cope with challenges linked to changing face of internet retailing. Additionally, Applied AI Market Dynamics: Efficiency needs for retail operations & supply chain management. Balanced inventory management systems enhanced through machine learning techniques allow proper demand forecasting thus reducing total costs besides minimizing stockouts resulting in better performance all through a supply chain. Predictive abilities of AI help in fast adapting to changing consumer trends as per past data and market analysis. In the developing retail landscape, improved operations brought about by artificial intelligence and better supply chain visibility are therefore essential.

Leave a Comment