Market Trends

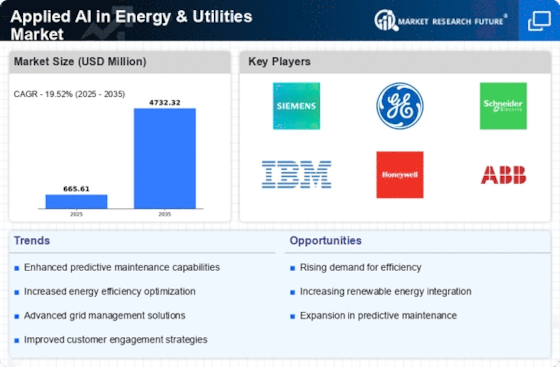

Key Emerging Trends in the Applied AI in Energy & Utilities Market

In the dynamic landscape of the Applied Artificial Intelligence (AI) in Energy & Utilities Market, companies employ diverse strategies to establish and enhance their market share. Technological innovation is a key driver where companies’ focus is on developing and offering AI solutions with advanced features and capabilities specific to needs of the utilities sector or those revolving around energy. This involves tapping into cutting-edge machine learning, predictive analytics, smart grid technologies among others, which offer improved performance over time; they help utility providers meet their internal demands for more efficient sustainable resilient solutions regarding power generation, distribution, and consumption

The pricing strategy plays an important role in positioning your market within this market place called Applied AI in Energy & Utilities Market. Some use cost leadership strategy which means they aim at lowering competitiors’ costs through providing cheaper alternatives while others strive to become premium brands by offering maintenance predictions system that optimizes grids besides providing comprehensive management services for different kinds of energies like solar wind hydro geothermal biomass nuclear cogeneration wave tidal ocean thermal etc.. And hence instead targeting premium customers who need best-in-class products from suppliers they target businesses focusing on quality improvement only thus paying them higher prices as well.

Collaborations and strategic partnerships emerge as critical components of market share positioning in the Applied AI in Energy & Utilities Market. Companies often seek alliances with utility infrastructure providers, equipment manufacturers or research institutions so that they could come up with ways that make it possible for them use their Artificial Intelligence Solution within these sectors much better than before.. Collaborative ventures can result in a broader ecosystem of services, increased market reach, and the ability to address the unique requirements of various utility settings. Additionally, partnerships with major players in the energy and utilities industry for joint projects or long-term contracts contribute to a stable revenue stream and a strengthened market presence.

Customer-centric strategies are paramount drivers for market share growth in the Applied AI in Energy & Utilities Market. Companies that prioritize utility efficiency, grid reliability, and responsive customer support build lasting relationships with energy providers. Positive user experiences contribute to customer loyalty, word-of-mouth recommendations, and a positive feedback loop for market share expansion. Understanding and addressing specific energy and utilities needs or use cases enable companies to tailor their AI solutions for targeted market segments, providing a competitive edge.

Leave a Comment