Applied Ai In Agriculture Size

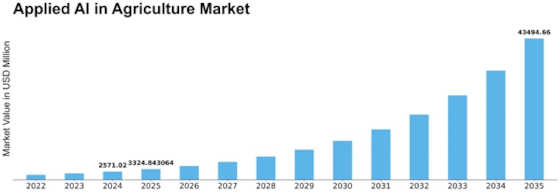

Applied AI in Agriculture Market Growth Projections and Opportunities

Growing demand for sustainable farming methods, coupled with the use of AI to solve the complex challenges in the agricultural industry, has greatly shaped market dynamics for applied AI in agriculture. Technologies such as computer vision and data analytics including machine learning constitute applied AI in agriculture that is aimed at improving various aspects of farm production from crop monitoring to pest control, yield prediction and resources management. This dynamic market has several drivers accounting for its volatility as AI continues to revolutionize agribusinesses.

Food productivity and sustainability are among key drivers of Applied AI Market dynamics on Agriculture. The world population will extend to over 9 billion by 2050 thus increasing need for more efficient agricultural practices to meet demand. Farmers today can use data-driven decisions and make resource allocation more efficient through application of artificial intelligence capabilities in their operations. The scale that can be covered by using Artificial Intelligence (AI) technology on soil conditions, weather patterns as well as satellite images is capable of leading to application of targeted interventions known as precision agriculture.

The development of precision agriculture influences several factors within the market dynamics of Applied AI in agriculture. Precision agriculture refers to an approach where the best farming practices are employed according to different parts within fields. In this regard, artificial intelligence comes into play enabling real-time insights and recommendations based on deep learning models. When it comes crop health evaluation, identification of anomalies or misfit cases like accurate usage fertilizers/pesticides – everything can be done using advanced algorithms developed specifically for crops protection or soil quality improvement purposes. As a result, adoption of precision-based farming driven by AI leads to increased yields, reduced input costs as well as environmental conservation.

Additionally, there is a significant demand for automation in farming operations driving applied artificial intelligence (AI) sector’s dynamics. Hence they are increasingly being used in planting, harvesting and monitoring processes by autonomous vehicles powered by artificial intelligence (AI), drones or even robots themselves . Moreover apart from reducing labor cost, these technologies improve precision and efficiency of various agricultural activities. Large scale production, especially, requires incorporation of such AI-based automation due to the large sizes of data and activities involved.

Leave a Comment