Emergence of API Economy

The emergence of the API economy is reshaping the Application Integration Market by facilitating seamless connectivity between applications and services. APIs enable organizations to leverage third-party services and integrate them into their existing systems, fostering innovation and enhancing functionality. As businesses increasingly adopt microservices architectures, the demand for robust API management and integration solutions is expected to rise. Recent studies indicate that the API management market is projected to grow at a compound annual growth rate of over 30%, reflecting the growing importance of APIs in driving business agility. This trend underscores the critical role of application integration in enabling organizations to harness the full potential of the API economy.

Regulatory Compliance and Data Security

Regulatory compliance and data security concerns are becoming paramount for organizations, thereby influencing the Application Integration Market. As data protection regulations become more stringent, businesses are compelled to implement integration solutions that ensure compliance while safeguarding sensitive information. The market for data integration solutions that prioritize security is expected to witness substantial growth, with estimates suggesting a rise in demand for secure application integration solutions. Organizations are increasingly seeking integration platforms that offer robust security features, such as encryption and access controls, to mitigate risks associated with data breaches. This focus on compliance and security is likely to drive the Application Integration Market as businesses prioritize secure and compliant integration practices.

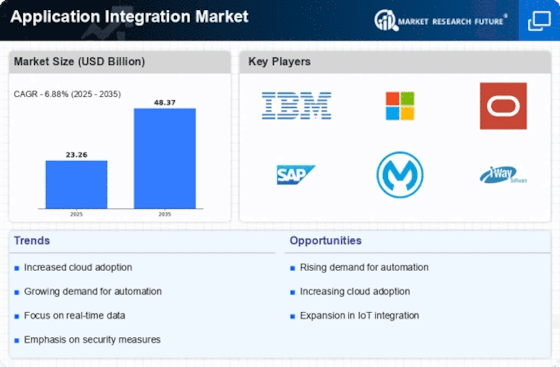

Rising Demand for Cloud-Based Solutions

The increasing adoption of cloud-based solutions is a primary driver for the Application Integration Market. Organizations are migrating their operations to the cloud to enhance scalability, flexibility, and cost-effectiveness. According to recent data, the cloud services market is projected to reach a valuation of over 800 billion dollars by 2025, indicating a robust growth trajectory. This shift necessitates seamless integration between on-premises systems and cloud applications, thereby propelling the demand for application integration solutions. As businesses seek to optimize their cloud environments, the Application Integration Market is likely to experience significant growth, driven by the need for efficient data flow and interoperability across diverse platforms.

Increased Focus on Digital Transformation

Digital transformation initiatives are reshaping the operational landscape for many organizations, thereby acting as a catalyst for the Application Integration Market. Companies are increasingly investing in technologies that facilitate the integration of disparate systems, applications, and data sources. This trend is underscored by the fact that nearly 70% of organizations have a digital transformation strategy in place. As businesses strive to enhance customer experiences and operational efficiencies, the demand for application integration solutions is expected to surge. The Application Integration Market stands to benefit from this focus on digital transformation, as organizations seek to create a cohesive digital ecosystem that supports innovation and agility.

Growing Need for Real-Time Data Processing

The necessity for real-time data processing is becoming increasingly critical in various sectors, thus driving the Application Integration Market. Organizations are recognizing the importance of timely data access for decision-making and operational efficiency. As a result, the market for real-time data integration solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 25% in the coming years. This demand is particularly pronounced in industries such as finance, healthcare, and retail, where timely insights can lead to competitive advantages. Consequently, the Application Integration Market is likely to expand as businesses invest in solutions that enable real-time data integration and analytics.