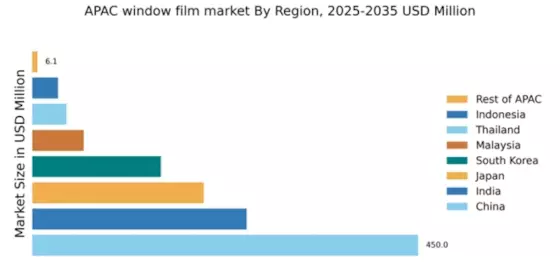

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 45% in the APAC window film sector, valued at $450.0 million. Key growth drivers include rapid urbanization, increasing energy efficiency awareness, and stringent government regulations promoting sustainable building practices. The demand for window films is rising, particularly in commercial and residential sectors, driven by energy conservation initiatives and aesthetic enhancements. Government policies, such as the Green Building Action Plan, further bolster this growth by incentivizing energy-efficient solutions. Infrastructure development, especially in megacities like Beijing and Shanghai, fuels consumption patterns favoring window films.

India : Rapid Growth in Urban Areas

India's window film market is valued at $250.0 million, accounting for 25% of the APAC share. The growth is driven by increasing disposable incomes, urbanization, and a rising awareness of energy conservation. Demand is particularly strong in metropolitan areas, where high temperatures drive the need for solar control films. Government initiatives like the National Energy Conservation Act promote energy-efficient solutions, enhancing market prospects. The construction boom in cities like Mumbai and Delhi is also a significant factor in consumption patterns.

Japan : Focus on Quality and Technology

Japan's window film market is valued at $200.0 million, representing 20% of the APAC market. The growth is driven by technological advancements and a strong emphasis on quality. Japanese consumers prioritize high-performance films that offer UV protection and energy efficiency. Regulatory policies support energy-saving technologies, aligning with Japan's commitment to sustainability. The market is characterized by a preference for premium products, particularly in urban centers like Tokyo and Osaka, where competition is fierce among established players like 3M and Llumar.

South Korea : Innovative Solutions for Urban Living

South Korea's window film market is valued at $150.0 million, capturing 15% of the APAC share. The growth is fueled by urbanization and a focus on energy efficiency in buildings. Demand for window films is rising in both residential and commercial sectors, driven by government initiatives promoting green building practices. Key cities like Seoul and Busan are pivotal markets, with a competitive landscape featuring major players like Solar Gard and Avery Dennison. The local market is dynamic, with applications in automotive, commercial, and residential sectors.

Malaysia : Emerging Demand in Urban Areas

Malaysia's window film market is valued at $60.0 million, accounting for 6% of the APAC market. The growth is driven by increasing urbanization and a rising awareness of energy efficiency. Government initiatives, such as the Green Building Index, promote sustainable building practices, enhancing demand for window films. Key markets include Kuala Lumpur and Penang, where the competitive landscape features local and international players. The market is characterized by a growing preference for solar control films in residential and commercial applications.

Thailand : Focus on Energy Efficiency Solutions

Thailand's window film market is valued at $40.0 million, representing 4% of the APAC share. The growth is driven by increasing temperatures and a focus on energy conservation. Government policies supporting energy efficiency initiatives enhance market prospects. Key cities like Bangkok are central to demand, with a competitive landscape featuring both local and international brands. The market is characterized by a growing interest in solar control films, particularly in the automotive and residential sectors.

Indonesia : Growing Demand in Urban Centers

Indonesia's window film market is valued at $30.0 million, capturing 3% of the APAC market. The growth is driven by rapid urbanization and increasing awareness of energy efficiency. Government initiatives promoting sustainable building practices are enhancing market prospects. Key cities like Jakarta and Surabaya are pivotal markets, with a competitive landscape featuring both local and international players. The market is characterized by a rising demand for solar control films in residential and commercial applications.

Rest of APAC : Diverse Opportunities Across Regions

The Rest of APAC window film market is valued at $6.1 million, representing a small share of the overall market. However, there are diverse opportunities for growth driven by increasing urbanization and awareness of energy efficiency. Countries like Vietnam and the Philippines are showing potential for market expansion. The competitive landscape is fragmented, with local players dominating. The market is characterized by a growing interest in solar control films, particularly in residential applications.