China : Unmatched Growth and Innovation Hub

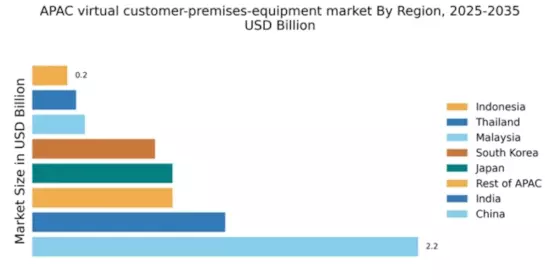

China holds a commanding market share of 2.2 in the virtual customer-premises-equipment (vCPE) sector, driven by rapid digital transformation and government initiatives promoting smart city projects. The demand for vCPE solutions is surging, fueled by the increasing adoption of cloud services and IoT applications. Regulatory support, such as the 14th Five-Year Plan, emphasizes technological advancement and infrastructure development, creating a conducive environment for market growth.

India : Emerging Market with High Potential

India's vCPE market is valued at 1.1, reflecting a robust growth trajectory. Key drivers include the government's Digital India initiative, which aims to enhance connectivity and digital services across urban and rural areas. The increasing demand for remote work solutions and cloud-based services is reshaping consumption patterns, while favorable regulatory policies are encouraging foreign investments in the tech sector.

Japan : A Leader in Advanced Solutions

Japan's vCPE market, valued at 0.8, is characterized by high technological adoption and innovation. The country's focus on 5G deployment and smart manufacturing drives demand for advanced vCPE solutions. Government initiatives, such as the Society 5.0 vision, promote digital transformation across industries, enhancing infrastructure and connectivity. The market is witnessing a shift towards integrated solutions that support IoT and AI applications.

South Korea : A Hub for Telecommunications Innovation

South Korea's vCPE market, valued at 0.7, is propelled by its advanced telecommunications infrastructure and high internet penetration. The government's commitment to 5G technology and smart city initiatives fosters a favorable environment for vCPE adoption. Demand is particularly strong in urban centers like Seoul and Busan, where businesses are increasingly leveraging cloud services and remote work solutions to enhance operational efficiency.

Malaysia : Emerging Market with Strategic Initiatives

Malaysia's vCPE market, valued at 0.3, is on an upward trajectory, driven by the government's initiatives to enhance digital infrastructure. The Malaysia Digital Economy Blueprint aims to boost connectivity and digital services, fostering demand for vCPE solutions. The market is characterized by increasing investments in cloud technologies and a growing number of SMEs adopting digital solutions to improve competitiveness.

Thailand : A Market with Expanding Opportunities

Thailand's vCPE market, valued at 0.25, is experiencing growth due to the government's Thailand 4.0 initiative, which emphasizes digital transformation across sectors. The demand for vCPE solutions is rising as businesses seek to enhance operational efficiency and customer engagement. Key cities like Bangkok are witnessing increased investments in digital infrastructure, creating a favorable environment for market players.

Indonesia : Digital Growth in Southeast Asia

Indonesia's vCPE market, valued at 0.2, is poised for growth, driven by increasing internet penetration and mobile connectivity. The government's initiatives to improve digital infrastructure and promote e-commerce are key growth drivers. Demand for vCPE solutions is rising among SMEs and startups, particularly in urban areas like Jakarta, where digital services are becoming essential for business operations.

Rest of APAC : A Mixed Landscape of Growth

The Rest of APAC region, with a market value of 0.8, presents diverse opportunities for vCPE solutions. Countries like Vietnam and the Philippines are witnessing rapid digital transformation, driven by government initiatives and increasing internet adoption. The competitive landscape is characterized by both local and international players, with a focus on tailored solutions for various industries, including finance and healthcare.