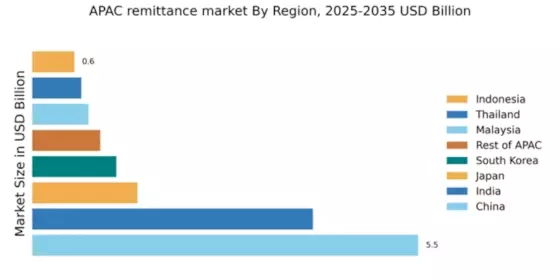

China : China's Unmatched Market Share

China holds a commanding 5.5% share of the APAC remittance market, valued at approximately $20 billion. Key growth drivers include a robust economy, increasing outbound migration, and a growing middle class. Demand trends show a shift towards digital remittance solutions, supported by government initiatives promoting fintech innovation. Regulatory policies are becoming more favorable, enhancing the infrastructure for cross-border transactions and digital payment systems.

India : India's Expanding Global Footprint

India captures 4.0% of the APAC remittance market, translating to around $15 billion. The growth is driven by a large diaspora, particularly in the US and UAE, and increasing digital payment adoption. Consumption patterns reflect a preference for low-cost remittance services, with government policies supporting financial inclusion. The infrastructure for remittances is improving, with more banks and fintechs entering the market.

Japan : Japan's Unique Consumer Preferences

Japan holds a 1.5% share of the APAC remittance market, valued at approximately $5 billion. Key growth drivers include an aging population and increasing outbound remittances to Southeast Asia. Demand trends indicate a preference for traditional remittance methods, although digital solutions are gaining traction. Regulatory frameworks are evolving to accommodate fintech innovations, enhancing the overall market environment.

South Korea : South Korea's Digital Transformation

South Korea accounts for 1.2% of the APAC remittance market, valued at about $4 billion. The growth is fueled by a significant expatriate community and increasing digital payment adoption. Demand trends show a shift towards mobile remittance solutions, supported by government initiatives promoting fintech. The competitive landscape features both traditional banks and new fintech entrants, enhancing service offerings.

Malaysia : Malaysia's Diverse Market Dynamics

Malaysia captures 0.8% of the APAC remittance market, valued at around $3 billion. Key growth drivers include a large migrant workforce and increasing digital remittance options. Demand trends reflect a preference for cost-effective services, with government policies supporting financial technology. The market is characterized by a mix of local and international players, creating a competitive environment.

Thailand : Thailand's Regional Connectivity

Thailand holds a 0.7% share of the APAC remittance market, valued at approximately $2.5 billion. The growth is driven by a significant number of expatriates and increasing digital payment solutions. Demand trends indicate a preference for quick and affordable remittance services, supported by government initiatives to enhance financial inclusion. The competitive landscape includes both traditional banks and emerging fintech companies.

Indonesia : Indonesia's Growing Demand for Services

Indonesia accounts for 0.6% of the APAC remittance market, valued at around $2 billion. Key growth drivers include a large population of overseas workers and increasing smartphone penetration. Demand trends show a shift towards mobile remittance solutions, with government policies encouraging digital financial services. The market is competitive, with both local and international players vying for market share.

Rest of APAC : Emerging Markets in Focus

The Rest of APAC captures 0.97% of the remittance market, valued at approximately $3.5 billion. Growth is driven by increasing migration and digital payment adoption across various countries. Demand trends reflect a preference for affordable and efficient remittance services, supported by government initiatives promoting financial inclusion. The competitive landscape features a mix of local and international players, enhancing service diversity.