China : Unmatched Growth and Demand Trends

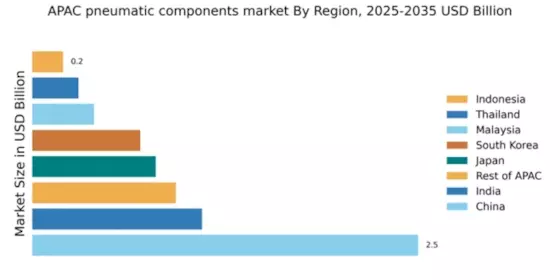

China holds a commanding 2.5% market share in the APAC pneumatic components sector, driven by rapid industrialization and urbanization. Key growth drivers include the government's push for automation and smart manufacturing, alongside increasing demand in sectors like automotive and electronics. Regulatory policies favoring innovation and investment in infrastructure further bolster market expansion. The country's robust industrial base supports a diverse consumption pattern, with a focus on high-quality pneumatic solutions.

India : Rapid Industrial Growth and Demand

India's pneumatic components market accounts for 1.1% of the APAC total, reflecting a burgeoning industrial landscape. The government's initiatives like 'Make in India' and investments in infrastructure are key growth drivers. Demand is rising in sectors such as manufacturing and construction, with a shift towards automation. Regulatory support and favorable policies are enhancing the business environment, fostering innovation and competition.

Japan : Innovation and Quality at Forefront

Japan's market share stands at 0.8%, characterized by a strong emphasis on technology and quality. The growth is propelled by advancements in automation and robotics, particularly in manufacturing sectors. Government policies promoting R&D and sustainability are crucial for market dynamics. The demand for high-performance pneumatic components is increasing, driven by the automotive and electronics industries.

South Korea : Competitive Landscape and Growth Drivers

South Korea holds a 0.7% share in the pneumatic components market, supported by a robust industrial framework. Key growth drivers include the rise of smart factories and automation technologies. The government is actively promoting innovation through various initiatives, enhancing the demand for advanced pneumatic solutions. The competitive landscape features major players like SMC Corporation and Parker Hannifin, focusing on high-tech applications.

Malaysia : Strategic Location and Development

Malaysia's pneumatic components market represents 0.4% of the APAC total, with significant growth potential. The manufacturing sector is a primary driver, supported by government initiatives to enhance industrial capabilities. Demand trends indicate a shift towards automation and efficiency. Regulatory frameworks are favorable, promoting foreign investment and technology transfer, which are vital for market growth.

Thailand : Industrial Growth and Investment Opportunities

Thailand's market share is 0.3%, with a focus on industrial growth and investment. The government's Eastern Economic Corridor initiative is a key driver, attracting investments in manufacturing and technology. Demand for pneumatic components is rising, particularly in automotive and electronics sectors. The competitive landscape includes both local and international players, fostering a dynamic business environment.

Indonesia : Infrastructure Growth and Demand Trends

Indonesia's pneumatic components market accounts for 0.2% of the APAC total, with significant untapped potential. The government's focus on infrastructure development and industrialization is driving demand. Key sectors include manufacturing and construction, with increasing interest in automation. Regulatory support is improving the business climate, encouraging investment and innovation in pneumatic technologies.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a market share of 0.93%, characterized by diverse economic conditions and industrial capabilities. Growth drivers vary by country, with some focusing on manufacturing while others emphasize technology and services. Regulatory environments are evolving, promoting investment and innovation. Demand trends indicate a growing interest in automation and efficiency across various sectors.