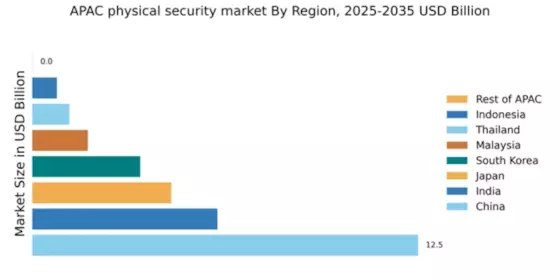

China : Unmatched Growth and Innovation

China holds a commanding 12.5% market share in the APAC physical security sector, driven by rapid urbanization and increasing security concerns. The government's push for smart city initiatives and stringent regulations on public safety are key growth drivers. Demand for advanced surveillance systems is surging, particularly in urban areas, as businesses and local authorities prioritize safety. Infrastructure development, including transportation and commercial hubs, further fuels this growth.

India : Growing Demand and Investment

India's physical security market accounts for 6.0% of the APAC total, reflecting a robust growth trajectory. Key drivers include rising crime rates, increased investment in infrastructure, and government initiatives like 'Smart Cities Mission'. The demand for integrated security solutions is on the rise, particularly in metropolitan areas, as businesses seek to enhance safety measures. Regulatory frameworks are evolving to support technological advancements in security.

Japan : Innovation Meets Tradition

Japan's market share stands at 4.5%, characterized by a strong emphasis on technology and innovation. The growth is propelled by the increasing adoption of IoT and AI in security systems, driven by both private and public sectors. Demand for high-quality surveillance and access control systems is rising, particularly in urban centers like Tokyo and Osaka. Government regulations are supportive of technological integration, enhancing the overall security landscape.

South Korea : Integration of Technology and Safety

South Korea holds a 3.5% share in the physical security market, with significant growth driven by advancements in smart technology. The government is actively promoting the use of smart surveillance systems, particularly in urban areas. Demand is increasing for integrated security solutions across various sectors, including retail and transportation. The competitive landscape features major players like Samsung and LG, who are innovating rapidly to meet market needs.

Malaysia : Growth Driven by Urbanization

Malaysia's physical security market represents 1.8% of the APAC total, with growth fueled by urbanization and increasing security needs. Key government initiatives focus on enhancing public safety and infrastructure development. Demand for surveillance systems is particularly strong in Kuala Lumpur and Penang, where commercial activities are booming. The competitive landscape includes both local and international players, adapting to the evolving market dynamics.

Thailand : Focus on Safety and Infrastructure

Thailand's market share is 1.2%, with growth driven by rising security concerns and infrastructure projects. The government is investing in public safety initiatives, which is boosting demand for physical security solutions. Key cities like Bangkok are seeing increased adoption of surveillance systems in both public and private sectors. The competitive landscape features a mix of local and international companies, responding to the growing market needs.

Indonesia : Challenges and Opportunities Ahead

Indonesia's physical security market accounts for 0.8% of the APAC total, with growth potential driven by urbanization and increasing crime rates. Demand for security solutions is rising, particularly in Jakarta and Surabaya, as businesses seek to enhance safety measures. However, regulatory challenges and infrastructure gaps remain. The market is characterized by a mix of local and international players, striving to capture emerging opportunities.

Rest of APAC : Varied Market Dynamics Across Regions

The Rest of APAC holds a minimal market share of 0.01%, but presents diverse opportunities for growth. Each country has unique security needs driven by local conditions and regulatory environments. Demand for physical security solutions varies widely, influenced by economic development and urbanization levels. The competitive landscape is fragmented, with both local and international players vying for market share in this diverse region.