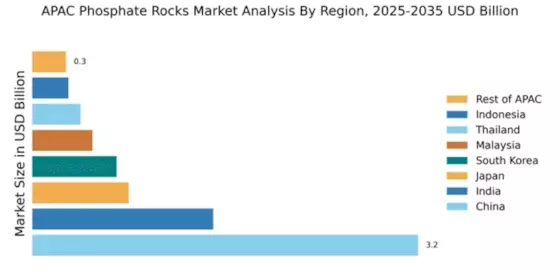

China : Robust Demand and Production Growth

China holds a commanding 3.2% market share in the APAC phosphate rocks market, driven by its extensive agricultural sector and increasing fertilizer demand. Key growth drivers include government initiatives promoting sustainable agriculture and investments in mining infrastructure. The country is witnessing a shift towards more efficient phosphate use, supported by regulatory policies aimed at reducing environmental impact. Industrial development in regions like Sichuan and Yunnan further boosts consumption patterns.

India : Growing Demand for Fertilizers

India accounts for 1.5% of the APAC phosphate rocks market, with significant growth driven by rising food production needs and government subsidies for fertilizers. The demand for phosphate is increasing, particularly in states like Punjab and Haryana, where agriculture is a primary economic driver. Regulatory support for domestic production and import policies are enhancing market dynamics, while infrastructure improvements in logistics are facilitating better distribution.

Japan : Innovation in Phosphate Usage

Japan's phosphate rocks market holds a 0.8% share, characterized by advanced agricultural practices and a focus on high-quality fertilizers. The growth is driven by technological innovations in fertilizer application and a strong emphasis on food security. Regulatory frameworks support sustainable practices, while urbanization in cities like Tokyo and Osaka influences consumption patterns, leading to a demand for specialized fertilizers tailored to local crops.

South Korea : Focus on Sustainable Practices

South Korea represents 0.7% of the APAC phosphate market, with growth fueled by strategic investments in agricultural technology and sustainability initiatives. The government promotes eco-friendly farming practices, which are driving demand for phosphate fertilizers. Key markets include Gyeonggi-do and Jeolla provinces, where competitive dynamics are shaped by major players like Yara International and local firms, enhancing the business environment for phosphate applications.

Malaysia : Emerging Player in Phosphate Market

Malaysia's phosphate rocks market accounts for 0.5% of the APAC total, with growth driven by the expanding agricultural sector and increasing palm oil production. The government supports fertilizer use through subsidies and initiatives aimed at enhancing crop yields. Key regions include Selangor and Johor, where local players are competing with international firms like Nutrien, creating a dynamic market landscape focused on sustainable agricultural practices.

Thailand : Key Player in Southeast Asia

Thailand holds a 0.4% share in the phosphate market, with growth driven by its diverse agricultural landscape, including rice and rubber production. Government policies promoting fertilizer use and sustainable farming practices are key growth drivers. Regions like Nakhon Ratchasima and Chachoengsao are pivotal markets, where local companies compete with international players, fostering a competitive environment that supports innovation in phosphate applications.

Indonesia : Focus on Domestic Fertilizer Production

Indonesia's phosphate rocks market comprises 0.3% of the APAC total, with growth driven by increasing domestic fertilizer production to meet agricultural needs. The government encourages local sourcing and sustainable practices, impacting demand positively. Key markets include West Java and Central Java, where local players are emerging alongside international firms, creating a competitive landscape that supports the agricultural sector's growth.

Rest of APAC : Varied Demand Across Sub-regions

The Rest of APAC accounts for 0.28% of the phosphate rocks market, characterized by diverse agricultural practices and varying demand trends. Growth is influenced by local regulations and market conditions, with countries like Vietnam and the Philippines showing potential for increased phosphate use. The competitive landscape is fragmented, with both local and international players vying for market share, adapting to unique regional challenges and opportunities.