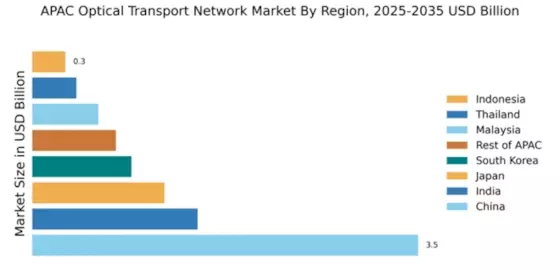

India : Emerging Market with High Demand

Key markets include metropolitan areas like Mumbai, Delhi, and Bangalore, where demand for optical networks is highest. The competitive landscape features major players like Cisco and Huawei, alongside local firms. The business environment is dynamic, with increasing collaborations between telecom operators and technology providers. Industries such as IT, education, and healthcare are rapidly adopting optical transport solutions to meet their connectivity needs.

Japan : Innovation-Driven Market Dynamics

Key cities like Tokyo and Osaka are at the forefront of this market, with significant investments in optical technologies. Major players such as Mitsubishi Electric and Nokia dominate the landscape, fostering a competitive environment. The business climate is favorable, with strong collaboration between public and private sectors. Industries like telecommunications, finance, and entertainment are increasingly leveraging optical transport networks for enhanced connectivity and service delivery.

South Korea : 5G and Smart City Initiatives

Seoul and Busan are pivotal markets, showcasing advanced optical network deployments. Major players like Samsung and Huawei are prominent, contributing to a competitive landscape. The local market dynamics favor collaboration between telecom operators and technology providers, enhancing service offerings. Industries such as transportation, healthcare, and entertainment are rapidly adopting optical transport solutions to meet their connectivity needs.

Malaysia : Growing Demand for Connectivity

Key markets include Kuala Lumpur and Penang, where demand for optical networks is on the rise. The competitive landscape features players like Cisco and Huawei, alongside local firms. The business environment is evolving, with increasing investments in digital infrastructure. Sectors such as telecommunications, education, and e-commerce are rapidly adopting optical transport solutions to enhance their service delivery.

Thailand : Investment in Digital Connectivity

Bangkok and Chiang Mai are key markets, showcasing significant growth in optical network deployments. Major players like Huawei and Nokia are active in the market, contributing to a competitive landscape. The local business environment is favorable, with increasing collaborations between telecom operators and technology providers. Industries such as tourism, education, and healthcare are increasingly leveraging optical transport solutions to meet their connectivity needs.

Indonesia : Focus on Connectivity and Growth

Key markets include Jakarta and Surabaya, where demand for optical networks is rising. The competitive landscape features players like Huawei and ZTE, alongside local firms. The business environment is evolving, with increasing investments in digital infrastructure. Sectors such as telecommunications, e-commerce, and education are rapidly adopting optical transport solutions to enhance their service delivery.

Rest of APAC : Emerging Markets and Innovations

Key markets include Ho Chi Minh City and Manila, where demand for optical networks is on the rise. The competitive landscape features a mix of global and local players, fostering innovation and collaboration. The business environment is dynamic, with increasing partnerships between telecom operators and technology providers. Industries such as finance, education, and healthcare are increasingly leveraging optical transport solutions to meet their connectivity needs.