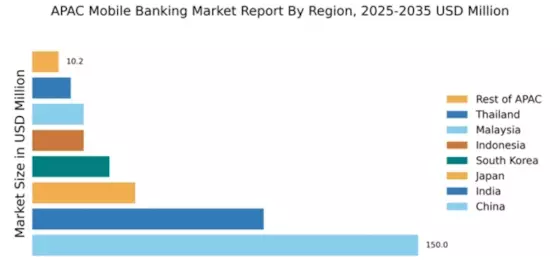

China : Unmatched Growth and Innovation

China holds a commanding market share of 150.0, representing a significant portion of the APAC mobile banking sector. Key growth drivers include rapid digitalization, a tech-savvy population, and government support for fintech innovations. Demand trends show a shift towards mobile payments and online banking services, driven by urbanization and increasing smartphone penetration. Regulatory policies, such as the Digital Currency Electronic Payment (DCEP) initiative, further bolster the sector, while robust infrastructure development enhances service delivery.

India : Digital Transformation in Finance

India's mobile banking market is valued at 90.0, showcasing a robust growth trajectory. Key drivers include the government's Digital India initiative, which promotes cashless transactions, and a growing middle class with increasing smartphone access. Demand for mobile banking services is surging, particularly in urban areas, as consumers seek convenience and efficiency. Regulatory frameworks, such as the Payment and Settlement Systems Act, support innovation and security in digital transactions.

Japan : Innovation Meets Tradition

Japan's mobile banking market is valued at 40.0, characterized by stable growth amidst a mature financial landscape. Key growth drivers include the integration of advanced technologies like AI and blockchain, alongside a strong emphasis on cybersecurity. Demand trends reflect a preference for secure and efficient banking solutions, particularly among younger consumers. Regulatory bodies, such as the Financial Services Agency, encourage innovation while ensuring consumer protection.

South Korea : Leading in Digital Finance

South Korea's mobile banking market is valued at 30.0, driven by high smartphone penetration and a tech-savvy population. Key growth drivers include the rise of fintech startups and government initiatives promoting digital finance. Demand for mobile banking services is particularly strong in urban centers like Seoul, where consumers favor seamless digital experiences. The competitive landscape features major players like KEB Hana Bank and Shinhan Bank, which are innovating to meet consumer needs.

Malaysia : Growth Through Innovation

Malaysia's mobile banking market is valued at 20.0, reflecting a growing adoption of digital financial services. Key growth drivers include government initiatives like the Financial Sector Blueprint, which aims to enhance financial inclusion. Demand trends indicate a rising preference for mobile payments, especially among younger demographics. The competitive landscape includes local banks and fintech companies, with Kuala Lumpur being a key market for mobile banking services.

Thailand : Adapting to Digital Trends

Thailand's mobile banking market is valued at 15.0, showing promising growth as digital adoption accelerates. Key growth drivers include the government's push for a cashless society and increasing smartphone usage. Demand for mobile banking services is particularly strong in urban areas like Bangkok, where consumers seek convenience. The competitive landscape features major players like Bangkok Bank and Kasikorn Bank, which are adapting to evolving consumer preferences.

Indonesia : Digital Finance Transformation

Indonesia's mobile banking market is valued at 20.0, driven by a young population and increasing smartphone penetration. Key growth drivers include government support for financial inclusion and the rise of fintech solutions. Demand trends show a growing preference for mobile banking services, particularly in urban areas like Jakarta. The competitive landscape includes local banks and fintech startups, which are innovating to capture the growing market.

Rest of APAC : Varied Market Dynamics

The Rest of APAC mobile banking market is valued at 10.2, showcasing diverse growth opportunities across different countries. Key growth drivers include varying levels of digital adoption and government initiatives aimed at enhancing financial inclusion. Demand trends reflect a mix of traditional banking and emerging fintech solutions. The competitive landscape varies significantly, with local players dominating in many regions, adapting to unique market conditions.