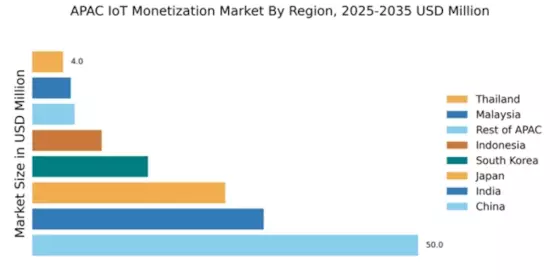

China : Unmatched Growth and Innovation

Key markets include major cities like Beijing, Shanghai, and Shenzhen, which are hubs for technology and innovation. The competitive landscape features significant players such as Alibaba, Huawei, and Tencent, alongside global giants like IBM and Microsoft. The local business environment is characterized by a strong push towards digital transformation across sectors like healthcare, transportation, and energy, with applications ranging from smart grids to connected vehicles.

India : Emerging Market with High Potential

Key markets include metropolitan areas like Bengaluru, Mumbai, and Delhi, which are technology hubs. The competitive landscape features local players like Reliance Jio and Wipro, alongside international firms such as Cisco and Amazon. The business environment is dynamic, with a focus on sectors like agriculture, healthcare, and smart cities, where IoT applications are rapidly being integrated to improve efficiency and service delivery.

Japan : Technology-Driven and Mature Market

Key markets include Tokyo, Osaka, and Nagoya, which are centers for technology and innovation. The competitive landscape is dominated by major players like Fujitsu, NEC, and Sony, alongside global firms such as Microsoft and IBM. The local business environment is characterized by a strong emphasis on quality and efficiency, with applications in sectors like manufacturing, healthcare, and transportation, where IoT solutions are increasingly being adopted.

South Korea : Leading in IoT Innovations

Key markets include Seoul, Busan, and Incheon, which are at the forefront of technology adoption. The competitive landscape features major players like Samsung, LG, and SK Telecom, alongside international firms such as Cisco and Amazon. The local business environment is vibrant, with a focus on sectors like smart homes, healthcare, and manufacturing, where IoT applications are being rapidly integrated to enhance efficiency and user experience.

Malaysia : Growth Driven by Digital Initiatives

Key markets include Kuala Lumpur, Penang, and Johor, which are central to technology development. The competitive landscape features local players like Telekom Malaysia and international firms such as IBM and Microsoft. The local business environment is evolving, with a focus on sectors like agriculture, transportation, and smart cities, where IoT applications are being increasingly adopted to improve efficiency and service delivery.

Thailand : Focus on Smart Solutions

Key markets include Bangkok, Chiang Mai, and Pattaya, which are pivotal for technology adoption. The competitive landscape features local players like True Corporation and international firms such as Cisco and Amazon. The local business environment is dynamic, with a focus on sectors like agriculture, tourism, and transportation, where IoT applications are being integrated to enhance efficiency and user experience.

Indonesia : Diverse Applications and Growth

Key markets include Jakarta, Surabaya, and Bandung, which are central to technology development. The competitive landscape features local players like Telkom Indonesia and international firms such as IBM and Microsoft. The local business environment is evolving, with a focus on sectors like agriculture, transportation, and smart cities, where IoT applications are being increasingly adopted to improve efficiency and service delivery.

Rest of APAC : Emerging Markets and Innovations

Key markets include emerging economies like Vietnam, Philippines, and Bangladesh, which are witnessing rapid technology adoption. The competitive landscape features a mix of local and international players, including regional firms and global giants like Cisco and Amazon. The local business environment is characterized by a focus on sectors like agriculture, healthcare, and urban development, where IoT applications are being integrated to enhance efficiency and service delivery.