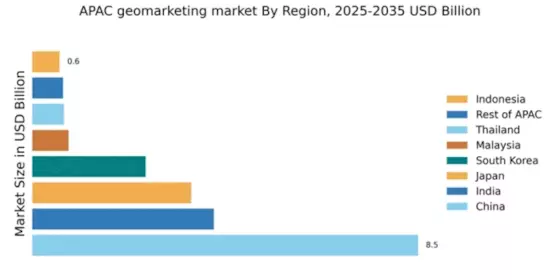

China : Rapid Growth and Innovation Hub

China holds a commanding 8.5% market share in the APAC geomarketing sector, driven by rapid urbanization and technological advancements. The demand for location-based services is surging, fueled by e-commerce growth and smart city initiatives. Government policies promoting digital infrastructure and data analytics are pivotal, alongside significant investments in AI and IoT technologies, enhancing the overall market landscape.

India : Diverse Needs and Rapid Adoption

India's geomarketing market is valued at 4.0%, reflecting a burgeoning demand for data-driven insights. Key growth drivers include the rise of mobile internet usage and increasing urbanization. Government initiatives like Digital India are promoting technology adoption, while the retail and logistics sectors are rapidly evolving, creating a favorable environment for geomarketing solutions.

Japan : Precision and Innovation at Forefront

Japan's geomarketing market stands at 3.5%, characterized by high consumer expectations and advanced technology integration. The growth is propelled by the demand for precision marketing and data analytics. Regulatory support for data privacy and innovation fosters a robust environment, while urban centers like Tokyo and Osaka lead in adopting geomarketing solutions.

South Korea : Innovation and Competition Drive Growth

South Korea's geomarketing market, valued at 2.5%, is marked by intense competition and innovation. The rise of mobile applications and smart city projects are key growth drivers. Government policies supporting digital transformation and infrastructure development are crucial. Major cities like Seoul and Busan are hotspots for geomarketing applications, with significant presence from global players like Google and Esri.

Malaysia : Strategic Location and Development Focus

Malaysia's geomarketing market is valued at 0.8%, with growth driven by increasing digital adoption and urban development. The government is actively promoting smart city initiatives, enhancing infrastructure and connectivity. Key markets include Kuala Lumpur and Penang, where local businesses are increasingly leveraging geomarketing for competitive advantage, supported by players like HERE Technologies.

Thailand : Tourism and Retail Driving Demand

Thailand's geomarketing market, at 0.7%, is experiencing growth fueled by tourism and retail sectors. The demand for location-based services is rising, supported by government initiatives to enhance digital infrastructure. Bangkok and Chiang Mai are key markets, with local businesses increasingly adopting geomarketing strategies to attract consumers, while competition remains moderate.

Indonesia : Rapid Urbanization and Digital Growth

Indonesia's geomarketing market is valued at 0.6%, with significant potential for growth driven by rapid urbanization and increasing smartphone penetration. Government initiatives to improve digital infrastructure are crucial. Key cities like Jakarta and Surabaya are emerging as focal points for geomarketing applications, with local startups and The geomarketing market.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC geomarketing market, valued at 0.68%, showcases diverse growth patterns influenced by local economic conditions. Countries like Vietnam and the Philippines are witnessing increased demand for geomarketing solutions, driven by urbanization and digital transformation. Local players are emerging, while global companies are adapting strategies to cater to unique regional needs.