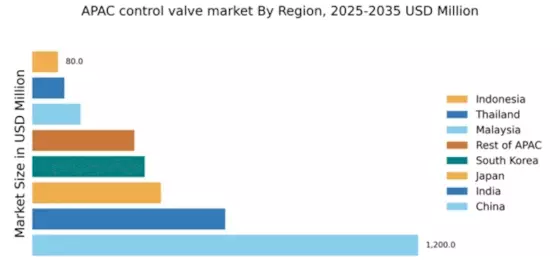

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 43.5% in the APAC control valve market, valued at $1200.0 million. Key growth drivers include rapid industrialization, urbanization, and government initiatives aimed at enhancing infrastructure. The demand for control valves is surging in sectors like oil and gas, water treatment, and power generation, supported by favorable regulatory policies that promote automation and efficiency in manufacturing processes. Significant investments in smart city projects further bolster market growth.

India : Infrastructure Development Fuels Growth

India accounts for 18.5% of the APAC control valve market, valued at $600.0 million. The growth is driven by extensive infrastructure projects, particularly in water supply and sanitation, as well as the oil and gas sector. Government initiatives like 'Make in India' and 'Smart Cities Mission' are enhancing local manufacturing capabilities and increasing demand for automation solutions. The consumption pattern reflects a shift towards high-efficiency valves to meet regulatory standards.

Japan : Advanced Solutions for Industry Needs

Japan holds a market share of 13.3%, valued at $400.0 million in the control valve sector. The growth is propelled by technological advancements and a strong focus on automation in manufacturing. Demand trends indicate a preference for smart valves that integrate with IoT systems, driven by the need for efficiency and reliability. Regulatory policies emphasize energy conservation and environmental sustainability, further influencing market dynamics.

South Korea : Key Player in Automation Solutions

South Korea represents 11.7% of the APAC market, valued at $350.0 million. The growth is fueled by a robust industrial base, particularly in petrochemicals and shipbuilding. Demand for control valves is increasing as industries adopt automation technologies to enhance productivity. Government policies supporting green technology and energy efficiency are also significant growth drivers, creating a favorable environment for market expansion.

Malaysia : Strategic Location for Industrial Growth

Malaysia captures a 4.5% share of the APAC control valve market, valued at $150.0 million. The market is driven by the oil and gas sector, alongside increasing investments in manufacturing and infrastructure. Demand trends show a rising preference for high-quality, durable valves that comply with international standards. Government initiatives aimed at enhancing industrial capabilities and attracting foreign investment are pivotal in shaping the market landscape.

Thailand : Diverse Applications Across Sectors

Thailand holds a 3.3% market share, valued at $100.0 million. The growth is supported by diverse applications in sectors such as food processing, chemicals, and water management. Demand for control valves is increasing as industries focus on improving operational efficiency and compliance with environmental regulations. Government policies promoting sustainable practices are also influencing market dynamics positively.

Indonesia : Investment in Infrastructure and Industry

Indonesia accounts for 2.7% of the APAC control valve market, valued at $80.0 million. The market is driven by significant investments in infrastructure and industrial development, particularly in the oil and gas sector. Demand trends indicate a growing need for reliable and efficient control systems to support expanding industries. Regulatory frameworks are gradually evolving to enhance operational standards and safety in manufacturing processes.

Rest of APAC : Varied Applications Across Sub-regions

The Rest of APAC region holds a market share of 5.5%, valued at $317.64 million. This segment includes various countries with distinct market characteristics and growth drivers. Demand trends vary widely, influenced by local industries such as agriculture, manufacturing, and energy. Regulatory policies are often tailored to specific national contexts, impacting market dynamics and competitive landscapes. The presence of both local and international players enriches the competitive environment.