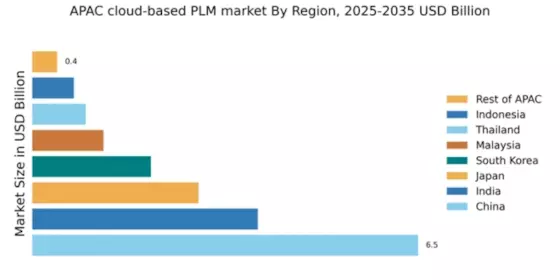

China : Rapid Growth and Innovation Hub

China holds a commanding 6.5% market share in the APAC cloud-based PLM sector, driven by robust industrial growth and increasing digital transformation initiatives. The government's push for smart manufacturing and Industry 4.0 has catalyzed demand for cloud solutions. Additionally, the rise of e-commerce and tech startups is reshaping consumption patterns, while supportive regulatory frameworks enhance infrastructure development.

India : Innovation and Investment Surge

Key markets include Bengaluru, Pune, and Hyderabad, which are tech hubs attracting major players like Siemens and PTC. The competitive landscape is characterized by a mix of global and local firms, fostering innovation. The business environment is increasingly favorable, with a growing emphasis on sectors like automotive, aerospace, and consumer goods, driving the adoption of PLM solutions.

Japan : Precision and Quality Focus

Tokyo and Osaka are pivotal markets, hosting major corporations like Dassault Systemes and Autodesk. The competitive landscape is dominated by established players, with a focus on sectors such as electronics, automotive, and pharmaceuticals. The business environment is characterized by high standards and a commitment to continuous improvement, making it conducive for PLM adoption.

South Korea : Innovation and Technology Leadership

Seoul and Busan are key markets, with significant presence from players like Oracle and SAP. The competitive landscape features a mix of local and international firms, fostering a vibrant business environment. Key sectors include electronics, automotive, and textiles, where PLM solutions are increasingly adopted to streamline processes and improve product quality.

Malaysia : Strategic Location for Manufacturing

Kuala Lumpur and Penang are significant markets, attracting major players like Infor and Autodesk. The competitive landscape is evolving, with local firms increasingly adopting PLM solutions. The business environment is favorable, with a focus on sectors such as electronics, automotive, and consumer goods, driving the demand for innovative PLM applications.

Thailand : Manufacturing Growth and Innovation

Bangkok and Chonburi are key markets, with significant presence from players like Siemens and PTC. The competitive landscape features a mix of local and international firms, fostering a vibrant business environment. Key sectors include automotive, electronics, and food processing, where PLM solutions are increasingly adopted to streamline processes and improve product quality.

Indonesia : Investment in Digital Transformation

Jakarta and Surabaya are pivotal markets, attracting attention from major players like Oracle and SAP. The competitive landscape is characterized by a mix of local and international firms, creating opportunities for innovation. Key sectors include textiles, automotive, and consumer goods, where PLM solutions are increasingly recognized for their potential to enhance operational efficiency.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include Vietnam, Philippines, and Singapore, each with unique competitive landscapes. Major players like Autodesk and Infor are establishing a presence, catering to local needs. The business environment is evolving, with a focus on sectors such as manufacturing, retail, and logistics, driving the adoption of PLM solutions.