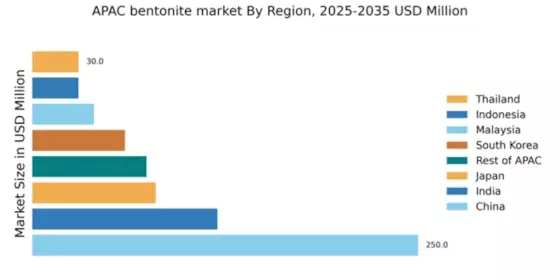

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 250.0, representing a significant portion of the APAC bentonite market. Key growth drivers include rapid industrialization, increasing demand in construction, and a robust ceramics industry. Government initiatives promoting infrastructure development and environmental regulations are also shaping consumption patterns. The country is witnessing a surge in demand for high-quality bentonite, particularly in the oil and gas sector, which is further supported by advancements in mining technology.

India : Strong Demand in Diverse Sectors

India's bentonite market is valued at 120.0, driven by the booming construction and automotive industries. The demand for bentonite in drilling fluids and foundry applications is on the rise, supported by government initiatives like 'Make in India' that encourage local manufacturing. Regulatory policies favoring sustainable mining practices are also influencing market dynamics, leading to increased consumption of eco-friendly bentonite products.

Japan : Innovation in Industrial Applications

Japan's bentonite market, valued at 80.0, is characterized by its focus on high-quality products and technological advancements. The demand is primarily driven by the ceramics and electronics sectors, where bentonite is used for its unique properties. Government regulations promoting environmental sustainability are pushing industries to adopt cleaner production methods, thereby increasing the consumption of bentonite in eco-friendly applications.

South Korea : Key Player in Advanced Manufacturing

South Korea's bentonite market is valued at 60.0, with significant growth driven by the electronics and automotive industries. The country is focusing on innovation and quality, leading to increased demand for specialized bentonite products. Government policies supporting R&D in materials science are enhancing the competitive landscape, while local players are investing in advanced mining technologies to meet rising consumption needs.

Malaysia : Infrastructure Development Boosts Market

Malaysia's bentonite market, valued at 40.0, is experiencing growth due to increased infrastructure projects and construction activities. The government's focus on urban development and sustainable building practices is driving demand for bentonite in various applications, including drilling and civil engineering. Regulatory frameworks promoting local sourcing of materials are also influencing market dynamics, leading to a rise in domestic production.

Thailand : Expanding Use in Agriculture and Industry

Thailand's bentonite market, valued at 30.0, is characterized by its diverse applications in agriculture, construction, and food processing. The growing awareness of sustainable agricultural practices is driving demand for bentonite as a soil conditioner. Government initiatives aimed at enhancing agricultural productivity are also contributing to market growth, while local players are focusing on product innovation to meet specific industry needs.

Indonesia : Focus on Sustainable Mining Practices

Indonesia's bentonite market, valued at 30.0, is in a growth phase, driven by increasing demand in the construction and oil drilling sectors. The government is promoting sustainable mining practices, which is influencing consumption patterns positively. Local players are exploring new applications for bentonite, particularly in environmental remediation and agriculture, to tap into the growing market potential.

Rest of APAC : Regional Growth Across Multiple Sectors

The Rest of APAC bentonite market, valued at 74.0, showcases diverse demand across various sectors, including agriculture, construction, and manufacturing. Countries in this category are experiencing growth driven by local industrialization and infrastructure projects. Regulatory policies promoting sustainable practices are influencing market dynamics, leading to increased consumption of eco-friendly bentonite products in these regions.