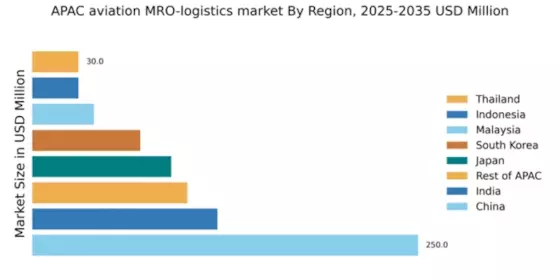

China : Strong Growth Driven by Demand

China holds a commanding market share of 250.0, representing a significant portion of the APAC aviation MRO-logistics sector. Key growth drivers include a booming domestic aviation industry, increased air travel demand, and government initiatives aimed at enhancing aviation infrastructure. Regulatory policies are supportive, with the Civil Aviation Administration of China (CAAC) promoting modernization and safety standards. Infrastructure development, including new airports and maintenance facilities, further fuels market expansion.

India : Emerging Market with High Potential

Key markets include major cities like Delhi, Mumbai, and Bengaluru, which host significant aviation activities. The competitive landscape features players like Hindustan Aeronautics Limited and Air India Engineering Services. The business environment is evolving, with a push for public-private partnerships and investment in MRO facilities. The commercial aviation sector is the primary driver, with a growing emphasis on regional connectivity.

Japan : Innovation and Quality at Forefront

Key markets include Tokyo and Osaka, where major airports and MRO facilities are located. The competitive landscape is dominated by companies like All Nippon Airways and Japan Airlines, which have established strong MRO operations. The business environment is characterized by a focus on high-quality service and efficiency. The aerospace sector, particularly commercial aviation, is a significant contributor to the MRO market.

South Korea : Growing Demand and Infrastructure Investment

Key markets include Seoul and Busan, which are home to major airports and MRO providers. The competitive landscape features companies like Korean Air and Asiana Airlines, which have established strong MRO capabilities. The business environment is favorable, with a focus on innovation and technology adoption. The commercial aviation sector is the primary driver, with increasing demand for both domestic and international flights.

Malaysia : Strategic Location and Growth Potential

Key markets include Kuala Lumpur and Penang, which host significant aviation activities. The competitive landscape features players like Malaysia Airlines and AirAsia, which are expanding their MRO capabilities. The business environment is evolving, with a focus on public-private partnerships and investment in technology. The commercial aviation sector is the primary driver, with a growing emphasis on regional connectivity.

Thailand : Investment and Infrastructure Development

Key markets include Bangkok and Phuket, which are home to major airports and MRO providers. The competitive landscape features companies like Thai Airways and Bangkok Airways, which have established strong MRO capabilities. The business environment is favorable, with a focus on innovation and technology adoption. The commercial aviation sector is the primary driver, with increasing demand for both domestic and international flights.

Indonesia : Growing Demand and Infrastructure Needs

Key markets include Jakarta and Bali, which host significant aviation activities. The competitive landscape features players like Garuda Indonesia and Lion Air, which are expanding their MRO capabilities. The business environment is evolving, with a focus on public-private partnerships and investment in MRO facilities. The commercial aviation sector is the primary driver, with a growing emphasis on regional connectivity.

Rest of APAC : Varied Growth and Investment Opportunities

Key markets include Singapore, Vietnam, and the Philippines, which host significant aviation activities. The competitive landscape features a mix of local and international players, including Boeing and Airbus, which have established strong MRO operations. The business environment is characterized by varying levels of investment and regulatory support. The commercial aviation sector is a significant contributor, with increasing demand for both domestic and international flights.