Growing Demand for Enhanced Vehicle Safety

The automotive position-sensors market in APAC is experiencing a surge in demand driven by the increasing emphasis on vehicle safety. Governments and regulatory bodies are implementing stringent safety standards, which necessitate the integration of advanced sensor technologies. This trend is particularly evident in countries like Japan and South Korea, where the automotive industry is rapidly evolving. The market for automotive position sensors is projected to grow at a CAGR of approximately 8% from 2025 to 2030, reflecting the industry's commitment to enhancing safety features. As consumers become more aware of safety issues, manufacturers are compelled to adopt innovative solutions, thereby propelling the automotive position-sensors market forward. The integration of these sensors not only improves safety but also enhances overall vehicle performance, making them indispensable in modern automotive design.

Increase in Automotive Production and Sales

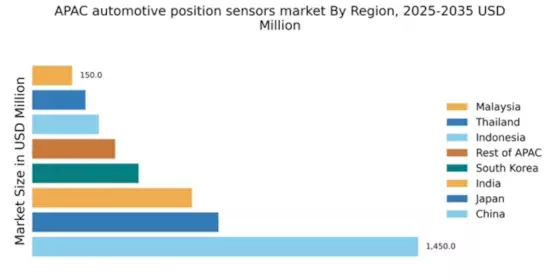

The automotive position-sensors market in APAC is benefiting from the robust increase in automotive production and sales. Countries like China and India are witnessing a significant rise in vehicle manufacturing, driven by a growing middle class and increasing disposable incomes. In 2025, the automotive production in China is projected to reach approximately 30 million units, which will inevitably boost the demand for position sensors. This growth is further supported by the expansion of manufacturing facilities and the introduction of new vehicle models. As automotive manufacturers strive to enhance vehicle features and performance, the demand for high-quality position sensors is likely to escalate. This trend indicates a promising outlook for the automotive position-sensors market, as manufacturers seek to incorporate advanced technologies to meet consumer expectations.

Shift Towards Sustainable Automotive Solutions

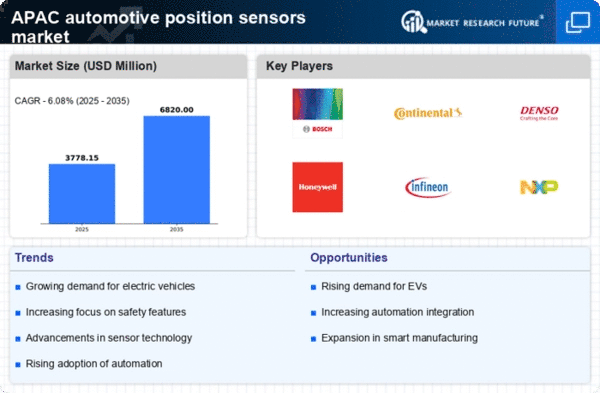

The automotive position-sensors market in APAC is increasingly influenced by the shift towards sustainable automotive solutions. As environmental concerns gain prominence, manufacturers are focusing on developing eco-friendly vehicles, which often require advanced sensor technologies for optimal performance. The rise of hybrid and electric vehicles is particularly notable, as these vehicles rely heavily on precise position sensing for efficient operation. The market is projected to grow by approximately 6% annually, driven by this shift. Additionally, governments in the region are offering incentives for the production of green vehicles, further stimulating demand for position sensors. This transition not only aligns with global sustainability goals but also presents a lucrative opportunity for the automotive position-sensors market to innovate and expand.

Rising Consumer Expectations for Vehicle Features

The automotive position-sensors market in APAC is significantly impacted by rising consumer expectations for advanced vehicle features. As consumers become more tech-savvy, they demand vehicles equipped with cutting-edge technologies that enhance comfort, safety, and performance. This trend is particularly evident in urban areas where consumers prioritize features such as automated parking and adaptive cruise control, which rely heavily on position sensors. The market is anticipated to grow at a rate of around 5% annually, as manufacturers strive to meet these evolving consumer demands. Consequently, automotive companies are increasingly investing in the development of sophisticated position-sensing technologies to differentiate their products in a competitive market. This focus on consumer preferences is likely to drive innovation and growth within the automotive position-sensors market.

Technological Advancements in Sensor Capabilities

Technological advancements are significantly influencing the automotive position-sensors market in APAC. Innovations in sensor technology, such as the development of MEMS (Micro-Electro-Mechanical Systems) sensors, are enhancing the precision and reliability of position sensing. These advancements enable more accurate data collection, which is crucial for applications in autonomous driving and advanced driver-assistance systems. The market is expected to witness a growth rate of around 7% annually, driven by these technological improvements. Furthermore, the integration of artificial intelligence and machine learning into sensor systems is likely to enhance their functionality, making them more adaptable to various driving conditions. As a result, manufacturers are increasingly investing in research and development to leverage these advancements, thereby fostering growth in the automotive position-sensors market.

Leave a Comment