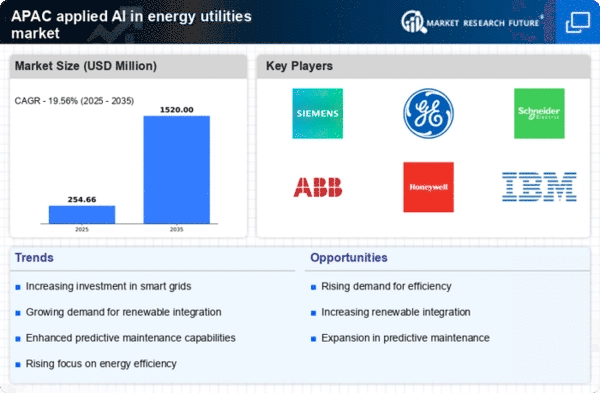

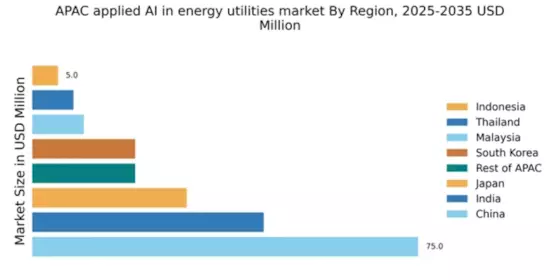

China : Unmatched Market Leadership and Growth

China holds a staggering 75.0% market share in the applied AI-in-energy-utilities sector, valued at approximately $15 billion. Key growth drivers include rapid urbanization, government initiatives promoting smart grid technologies, and increasing investments in renewable energy. Demand trends show a shift towards AI-driven efficiency solutions, supported by regulatory policies aimed at reducing carbon emissions and enhancing energy security. Infrastructure development, particularly in major cities like Beijing and Shanghai, further fuels this growth.

India : Transforming Energy Landscape with AI

India's market share stands at 45.0%, translating to a value of around $9 billion. The growth is driven by government initiatives like the Smart Cities Mission and increasing energy demands from urban centers. Consumption patterns are shifting towards renewable sources, with a notable rise in AI applications for grid management and energy efficiency. Regulatory frameworks are evolving to support these innovations, enhancing the overall industrial landscape.

Japan : Pioneering Smart Energy Solutions

Japan commands a 30.0% market share, valued at approximately $6 billion. The growth is propelled by technological advancements and a strong focus on energy efficiency post-Fukushima. Demand for AI solutions in predictive maintenance and grid optimization is rising, supported by government policies promoting innovation in energy technologies. The industrial sector is increasingly adopting AI to enhance operational efficiency and sustainability.

South Korea : Innovative Solutions for Energy Challenges

South Korea holds a 20.0% market share, valued at about $4 billion. The growth is driven by the government's Green New Deal, which emphasizes renewable energy and smart grid technologies. Demand for AI applications in energy management is increasing, particularly in urban areas like Seoul. The competitive landscape features major players like Samsung and LG, focusing on AI-driven energy solutions to meet local market needs.

Malaysia : Strategic Growth in Energy Sector

Malaysia's market share is 10.0%, valued at approximately $2 billion. The growth is supported by government initiatives aimed at enhancing energy efficiency and sustainability. Demand for AI technologies in energy management is on the rise, particularly in industrial sectors. Regulatory frameworks are evolving to facilitate the adoption of smart technologies, fostering a conducive business environment for local and international players.

Thailand : Transforming Utilities with Technology

Thailand's market share stands at 8.0%, valued at around $1.6 billion. The growth is driven by increasing energy demands and government policies promoting renewable energy. Demand for AI solutions in energy management is growing, particularly in urban areas like Bangkok. The competitive landscape includes local firms and international players, focusing on innovative solutions to enhance energy efficiency and sustainability.

Indonesia : Growing Demand for Smart Solutions

Indonesia holds a 5.0% market share, valued at approximately $1 billion. The growth is driven by rising energy consumption and government initiatives aimed at improving energy access. Demand for AI technologies in energy management is increasing, particularly in urban centers like Jakarta. The competitive landscape features both local and international players, focusing on innovative solutions to address energy challenges in the region.

Rest of APAC : Varied Market Dynamics Across Regions

The Rest of APAC accounts for a 20.0% market share, valued at around $4 billion. Growth is driven by varying energy demands and government initiatives across different countries. Demand for AI solutions in energy management is increasing, with a focus on enhancing efficiency and sustainability. The competitive landscape includes a mix of local and international players, each adapting to unique market conditions and regulatory environments.