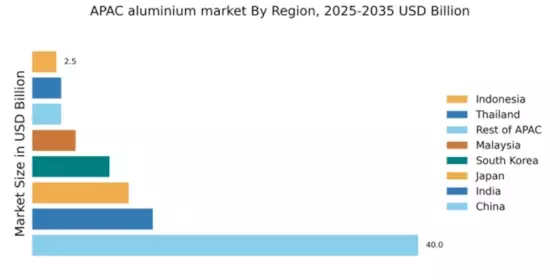

China : Unmatched Production and Demand Growth

Key markets include major cities like Shanghai, Beijing, and Guangzhou, where industrial activities are concentrated. The competitive landscape features dominant players such as China Hongqiao Group and Alcoa, which have established a strong foothold. Local market dynamics are characterized by a focus on innovation and sustainability, with applications spanning automotive, aerospace, and packaging industries. The business environment is increasingly favorable, supported by government incentives for technological advancements.

India : Rapid Growth in Demand and Production

Key markets include Maharashtra, Gujarat, and Odisha, where major aluminium production facilities are located. The competitive landscape features players like Hindalco and Novelis, which are expanding their operations. Local market dynamics are influenced by a growing middle class and urbanization, leading to increased demand for aluminium products. The business environment is improving, with favorable policies encouraging foreign investment and technological advancements.

Japan : Technological Innovation and Sustainability Focus

Key markets include Tokyo, Osaka, and Nagoya, where major industrial activities are concentrated. The competitive landscape features established players like Norsk Hydro and Rusal, which focus on innovation and quality. Local market dynamics are shaped by a strong manufacturing sector and a commitment to sustainability. The business environment is stable, with ongoing investments in R&D to enhance product offerings and meet evolving consumer demands.

South Korea : Strong Demand in Electronics and Automotive

Key markets include Seoul, Busan, and Incheon, where major industrial hubs are located. The competitive landscape features players like South32 and Alcoa, which are investing in local production capabilities. Local market dynamics are influenced by a strong emphasis on technology and quality, with applications spanning automotive, electronics, and construction. The business environment is favorable, supported by government initiatives to enhance competitiveness.

Malaysia : Strategic Location and Investment Opportunities

Key markets include Selangor, Penang, and Johor, where significant aluminium production facilities are located. The competitive landscape features local players and international firms, creating a dynamic market environment. Local market dynamics are characterized by a growing demand for aluminium products in construction and packaging. The business environment is improving, with government incentives encouraging technological advancements and sustainability initiatives.

Thailand : Focus on Sustainable Development

Key markets include Bangkok, Chonburi, and Rayong, where industrial activities are concentrated. The competitive landscape features local players and international firms, fostering a dynamic market environment. Local market dynamics are influenced by a growing emphasis on sustainability and innovation. The business environment is becoming more favorable, with government initiatives supporting investment in aluminium production and technology.

Indonesia : Investment in Infrastructure and Industry

Key markets include Jakarta, Surabaya, and Batam, where significant industrial activities are located. The competitive landscape features local players and international firms, creating opportunities for growth. Local market dynamics are characterized by a focus on infrastructure development and investment in technology. The business environment is improving, with government support for aluminium production and sustainable practices.

Rest of APAC : Varied Demand Across Sub-regions

Key markets include Vietnam, Philippines, and Singapore, where industrial activities are growing. The competitive landscape features a mix of local and international players, fostering a dynamic market environment. Local market dynamics are influenced by varying economic conditions and industrial growth rates. The business environment is evolving, with increasing investments in aluminium production and technology across the region.