Rising Healthcare Expenditure

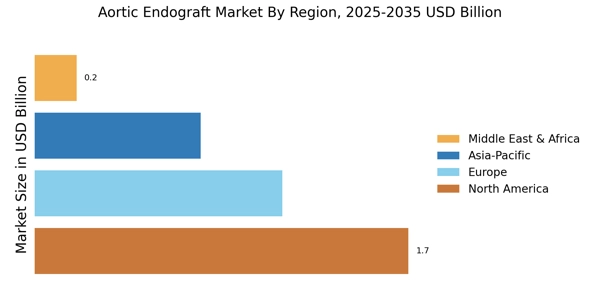

The Aortic Endograft Market is positively impacted by the rising healthcare expenditure observed in various regions. Increased investment in healthcare infrastructure and services is facilitating the availability of advanced medical technologies, including aortic endografts. As healthcare systems allocate more resources towards innovative treatment options, the accessibility of endovascular procedures is likely to improve. This trend is particularly evident in regions where governments are prioritizing healthcare reforms and expanding insurance coverage for minimally invasive procedures. Consequently, patients are more likely to seek treatment for aortic diseases, leading to a higher demand for endografts. Moreover, as healthcare expenditure continues to rise, manufacturers are encouraged to invest in research and development, resulting in the introduction of new and improved aortic endograft products. This dynamic is expected to further stimulate growth within the Aortic Endograft Market.

Increasing Awareness and Education

The Aortic Endograft Market is witnessing a growing emphasis on awareness and education regarding aortic diseases and their treatment options. Healthcare professionals and organizations are actively engaging in initiatives aimed at educating both clinicians and patients about the risks associated with aortic conditions. This heightened awareness is crucial, as it encourages early diagnosis and timely intervention, which are essential for improving patient outcomes. Furthermore, educational programs and workshops are being organized to inform healthcare providers about the latest advancements in endovascular techniques and technologies. As a result, the demand for aortic endografts is likely to increase, as more clinicians become aware of the benefits of these minimally invasive procedures. This trend may also lead to a more informed patient population, which could further drive the adoption of aortic endografts in clinical practice.

Rising Incidence of Aortic Diseases

The Aortic Endograft Market is significantly influenced by the rising incidence of aortic diseases, including aortic aneurysms and dissections. Epidemiological studies indicate that the prevalence of these conditions is on the rise, particularly among aging populations. As the global population ages, the number of individuals at risk for aortic diseases increases, thereby driving demand for effective treatment solutions. According to recent data, aortic aneurysms affect approximately 1-2% of the population over the age of 65, highlighting the urgent need for intervention. This growing patient population is likely to propel the adoption of aortic endografts, as they offer minimally invasive alternatives to traditional surgical approaches. Consequently, healthcare providers are increasingly turning to endovascular techniques, which are associated with shorter recovery times and reduced hospital stays, further contributing to the expansion of the Aortic Endograft Market.

Regulatory Developments in Aortic Endograft Market

The Aortic Endograft Market is also shaped by ongoing regulatory developments that aim to ensure the safety and efficacy of medical devices. Regulatory bodies are continuously updating guidelines and standards for the approval of new endograft technologies, which can impact market dynamics. For instance, the introduction of expedited review processes for innovative devices may facilitate faster market entry for new products, thereby enhancing competition. Additionally, stringent post-market surveillance requirements are being implemented to monitor the long-term performance of endografts, ensuring that they meet safety standards. These regulatory changes not only foster innovation but also instill confidence among healthcare providers and patients regarding the reliability of aortic endografts. As a result, the market is likely to benefit from increased investment in research and development, leading to the introduction of advanced products that meet evolving clinical needs.

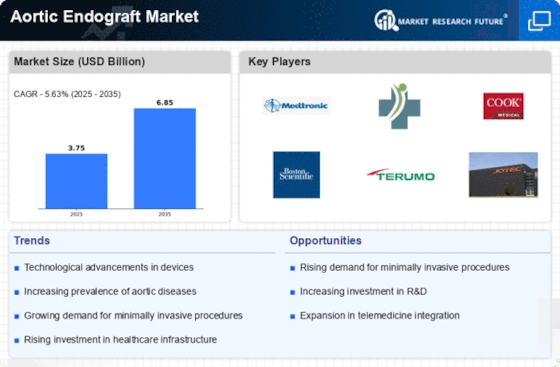

Technological Advancements in Aortic Endograft Market

The Aortic Endograft Market is experiencing a surge in technological advancements that enhance the efficacy and safety of endovascular procedures. Innovations such as the development of next-generation endografts, which incorporate advanced materials and design features, are becoming increasingly prevalent. These advancements not only improve the durability and performance of the devices but also reduce the risk of complications during and after procedures. For instance, the introduction of customizable endografts allows for tailored solutions that cater to individual patient anatomies, thereby optimizing treatment outcomes. Furthermore, the integration of imaging technologies, such as 3D imaging and real-time monitoring, is revolutionizing the way clinicians approach aortic interventions. As a result, the market is likely to witness a robust growth trajectory, driven by the demand for safer and more effective treatment options.