North America : Market Leader in Anti Jamming

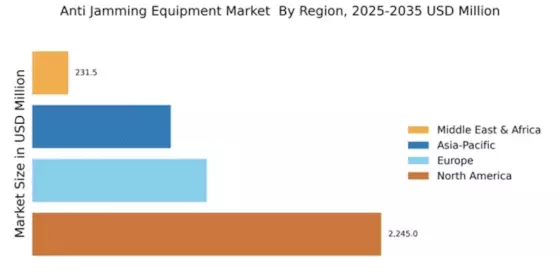

North America is poised to maintain its leadership in the Anti Jamming Equipment Market, holding a significant market share of $2245.0M in 2024. The region's growth is driven by increasing defense budgets, technological advancements, and a rising demand for secure communication systems. Regulatory support from government agencies further catalyzes market expansion, ensuring compliance with stringent security standards.

The competitive landscape is characterized by major players such as Northrop Grumman, Raytheon Technologies, and Lockheed Martin, which are at the forefront of innovation. The U.S. remains the leading country, leveraging its advanced technological capabilities and robust defense infrastructure. This concentration of key players fosters a dynamic environment for growth and collaboration, positioning North America as a hub for anti-jamming solutions.

Europe : Emerging Market with Growth Potential

Europe is witnessing a growing demand for Anti Jamming Equipment, with a market size of $1122.5M projected for 2025. The region's growth is fueled by increasing geopolitical tensions and the need for enhanced communication security. Regulatory frameworks, such as the European Union's defense initiatives, are pivotal in shaping market dynamics and encouraging investment in advanced technologies.

Leading countries like the UK, France, and Germany are at the forefront of this market, supported by key players such as Thales Group and BAE Systems. The competitive landscape is evolving, with a focus on innovation and collaboration among defense contractors. This strategic positioning is essential for addressing the unique challenges faced by European nations in maintaining secure communication channels.

Asia-Pacific : Rapidly Growing Defense Sector

The Asia-Pacific region is emerging as a significant player in the Anti Jamming Equipment Market, with a projected size of $891.0M by 2025. The growth is driven by increasing military expenditures and the need for secure communication in defense operations. Countries are investing in advanced technologies to counteract jamming threats, supported by favorable government policies and initiatives aimed at enhancing national security.

Key players such as L3Harris Technologies and Elbit Systems are actively expanding their presence in countries like India, Japan, and Australia. The competitive landscape is characterized by strategic partnerships and collaborations, enabling the region to leverage technological advancements and meet the growing demand for anti-jamming solutions. This dynamic environment positions Asia-Pacific as a critical market for future growth.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region is gradually developing its Anti Jamming Equipment Market, with a size of $231.5M anticipated by 2025. The growth is primarily driven by increasing defense budgets and the need for secure communication in conflict-prone areas. Regional instability and geopolitical tensions are significant catalysts for investment in advanced anti-jamming technologies, supported by government initiatives aimed at enhancing national security.

Countries like the UAE and South Africa are leading the charge, with key players such as Leonardo S.p.A. and General Dynamics establishing a foothold in the region. The competitive landscape is evolving, with a focus on local partnerships and collaborations to address unique regional challenges. This strategic approach is essential for fostering growth and ensuring the effective deployment of anti-jamming solutions.