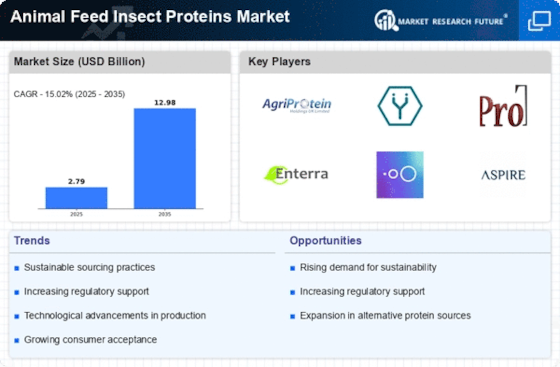

Economic Viability

The economic advantages associated with insect protein production are likely to influence the Animal Feed Insect Proteins Market positively. Insects can be reared on organic waste materials, which reduces feed costs and enhances profitability for producers. Furthermore, the relatively low resource requirements for insect farming, such as water and land, make it an economically attractive option compared to traditional livestock farming. Market analyses indicate that the cost of producing insect protein is decreasing as technology advances and production scales up. This economic viability could encourage more farmers and feed manufacturers to consider insect proteins as a viable alternative, potentially leading to increased market penetration and growth.

Regulatory Support

Regulatory frameworks are evolving to support the integration of insect proteins into animal feed, which may serve as a crucial driver for the Animal Feed Insect Proteins Market. Various countries are beginning to establish guidelines and safety standards for the use of insect-derived ingredients in livestock feed. This regulatory backing not only legitimizes the use of insect proteins but also encourages research and development within the sector. For example, the European Union has made strides in approving certain insect species for animal feed, which could potentially open up new markets and applications. As regulations become more favorable, the industry may witness accelerated growth and wider adoption of insect proteins in feed formulations.

Nutritional Benefits

The nutritional profile of insect proteins is emerging as a compelling driver for the Animal Feed Insect Proteins Market. Insects are rich in essential amino acids, vitamins, and minerals, making them a highly nutritious alternative to conventional protein sources. Studies suggest that incorporating insect protein into animal feed can enhance growth rates and overall health in livestock and aquaculture. For instance, the protein content in certain insect species can reach up to 70%, which is significantly higher than that of traditional feed ingredients. This nutritional advantage is likely to resonate with feed manufacturers and farmers, who are increasingly prioritizing animal health and productivity, thereby propelling the demand for insect-based feed solutions.

Sustainability Initiatives

The increasing emphasis on sustainability within the agricultural sector appears to be a pivotal driver for the Animal Feed Insect Proteins Market. As environmental concerns escalate, stakeholders are seeking alternative protein sources that minimize ecological footprints. Insect proteins, derived from species such as black soldier flies and mealworms, offer a sustainable solution due to their efficient feed conversion ratios and lower greenhouse gas emissions compared to traditional livestock. Reports indicate that insect protein production can utilize organic waste, further enhancing sustainability. This shift towards eco-friendly practices is likely to attract investments and foster innovation within the industry, potentially leading to a broader acceptance of insect proteins in animal feed formulations.

Consumer Demand for Alternative Proteins

The rising consumer demand for alternative protein sources is emerging as a significant driver for the Animal Feed Insect Proteins Market. As consumers become more health-conscious and environmentally aware, there is a growing interest in sustainable and nutritious food options. This trend is influencing the livestock and aquaculture sectors to explore alternative protein sources, including insect proteins, to meet consumer expectations. Market Research Future indicates that the demand for insect-based feed is likely to increase as more consumers advocate for sustainable practices in food production. This shift in consumer preferences could drive feed manufacturers to innovate and incorporate insect proteins into their products, thereby expanding the market.