Evolving Culinary Trends

Evolving culinary trends significantly impact the Global Animal-Based Food and Beverage Market Industry, as consumers increasingly explore diverse flavors and cuisines. The rise of gourmet and artisanal products reflects a shift towards premium offerings, with consumers willing to pay more for unique and high-quality animal-based foods. This trend is supported by the growing popularity of cooking shows and food blogs, which inspire individuals to experiment with new recipes. As culinary preferences continue to evolve, the industry must adapt its product lines to cater to these changing tastes, potentially driving market growth.

Rising Global Population

The Global Animal-Based Food and Beverage Market Industry experiences a notable increase in demand driven by the rising global population, which is projected to reach approximately 9.7 billion by 2050. This demographic shift necessitates a substantial increase in food production, particularly in animal-based products, to meet the dietary needs of a growing populace. As of 2024, the market is valued at 1443.2 USD Billion, reflecting the urgent need for sustainable practices in animal agriculture. The industry must adapt to these changing dynamics, ensuring that supply can keep pace with demand while addressing environmental concerns.

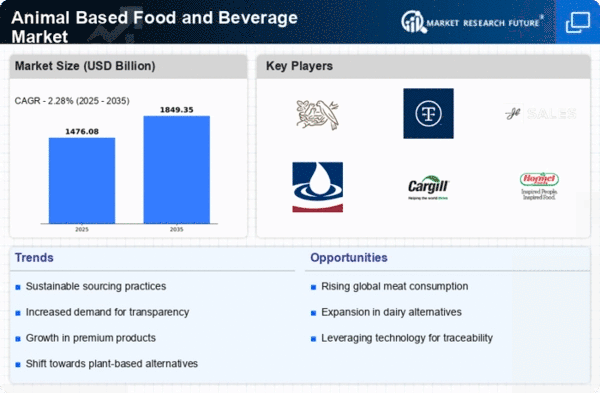

Market Growth Projections

The Global Animal-Based Food and Beverage Market Industry is projected to experience steady growth, with a market value of 1443.2 USD Billion in 2024 and an anticipated increase to 1850 USD Billion by 2035. This growth represents a compound annual growth rate (CAGR) of 2.28% from 2025 to 2035. Such projections indicate a robust demand for animal-based products, driven by various factors including population growth, health trends, and technological advancements. As the industry adapts to these dynamics, it is likely to witness continued expansion and innovation.

Sustainability and Ethical Considerations

Sustainability and ethical considerations are becoming increasingly important in the Global Animal-Based Food and Beverage Market Industry. Consumers are more aware of the environmental impact of animal agriculture and are demanding transparency in sourcing and production practices. This shift has led to a rise in demand for sustainably sourced and ethically produced animal products. Companies that prioritize these values may find themselves better positioned in the market, as consumers are likely to support brands that align with their ethical beliefs. This trend could influence market dynamics and drive growth as the industry evolves.

Technological Advancements in Food Production

Technological advancements play a crucial role in shaping the Global Animal-Based Food and Beverage Market Industry. Innovations in breeding, feed efficiency, and processing technologies enhance productivity and sustainability within the sector. For instance, precision farming techniques and genetic improvements in livestock contribute to higher yields and reduced environmental impact. These advancements not only support the industry's growth but also align with the projected market value of 1850 USD Billion by 2035. As technology continues to evolve, it is likely to drive further efficiencies and innovations in animal-based food production.

Health Consciousness and Nutritional Awareness

There is a growing trend towards health consciousness and nutritional awareness among consumers, which significantly influences the Global Animal-Based Food and Beverage Market Industry. Consumers increasingly seek high-quality animal products that offer nutritional benefits, such as protein-rich meats and dairy products. This shift is evident as more individuals prioritize their health, leading to a surge in demand for organic and grass-fed options. As the market evolves, it is essential for producers to align their offerings with these health trends, potentially enhancing market growth as the industry adapts to consumer preferences.