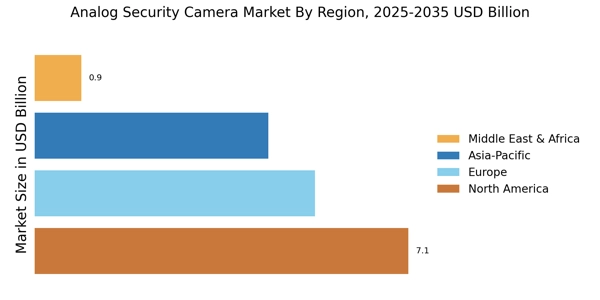

Growing Demand in Emerging Markets

The Analog Security Camera Market is experiencing a surge in demand within emerging markets, where rapid urbanization and increasing crime rates are prompting investments in security infrastructure. Countries in Asia and Africa are witnessing significant growth in the adoption of analog security cameras, as these regions often prioritize cost-effective solutions. According to recent estimates, the market in these areas is expected to grow at a compound annual growth rate of around 8% through 2027. This trend indicates a robust opportunity for manufacturers and suppliers within the Analog Security Camera Market to cater to the unique needs of these developing regions. The combination of rising security concerns and the affordability of analog systems positions them as a preferred choice for many consumers in these markets.

Cost-Effectiveness of Analog Systems

The Analog Security Camera Market benefits from the cost-effectiveness of analog systems, which are often more affordable than their digital counterparts. This affordability makes them an attractive option for small to medium-sized enterprises and residential users. The initial investment for analog cameras is generally lower, and they require less complex infrastructure, which can lead to significant savings. As of 2025, the average price of an analog camera is estimated to be around 30 to 50% less than that of a comparable IP camera. This price advantage is likely to drive demand, particularly in regions where budget constraints are prevalent. Consequently, the cost-effectiveness of analog systems is a key driver in the Analog Security Camera Market, appealing to a broad spectrum of consumers seeking reliable security solutions without substantial financial outlay.

Ease of Installation and Maintenance

The Analog Security Camera Market is characterized by the ease of installation and maintenance associated with analog systems. These cameras typically utilize coaxial cables, which are simpler to install compared to the networking requirements of IP cameras. This simplicity allows for quicker deployment, making them particularly appealing for users who may lack technical expertise. Furthermore, maintenance of analog systems is often less complicated, as they do not require extensive software updates or network configurations. As a result, the Analog Security Camera Market sees a steady influx of customers who prioritize straightforward solutions. In 2025, it is projected that approximately 60% of installations will favor analog systems due to these practical advantages, reinforcing their position in the market.

Regulatory Compliance and Safety Standards

The Analog Security Camera Market is influenced by increasing regulatory compliance and safety standards across various sectors. Governments and regulatory bodies are implementing stricter guidelines for surveillance and security measures, particularly in public spaces and commercial establishments. This trend compels businesses to invest in security solutions that meet these standards, thereby driving demand for analog cameras, which are often easier to integrate into existing systems. As of 2025, it is estimated that compliance-related investments in security systems will account for approximately 15% of total spending in the market. This regulatory landscape creates a favorable environment for the Analog Security Camera Market, as organizations seek to ensure compliance while maintaining cost efficiency.

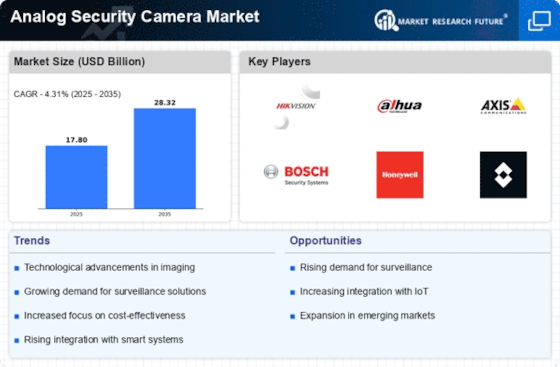

Technological Advancements in Analog Systems

The Analog Security Camera Market is witnessing technological advancements that enhance the performance and functionality of analog systems. Innovations such as high-definition analog cameras and improved image processing technologies are making these systems more competitive against digital alternatives. These advancements not only improve image quality but also expand the capabilities of analog cameras, such as night vision and motion detection. As of 2025, it is projected that the market for high-definition analog cameras will grow by approximately 20%, indicating a shift in consumer preferences towards enhanced features. This evolution within the Analog Security Camera Market suggests that analog systems are not merely relics of the past but are evolving to meet contemporary security needs.