Advancements in Manufacturing Techniques

Innovations in manufacturing techniques are significantly influencing the Amorphous Iron Market. The development of advanced production methods, such as rapid solidification and thin-film technology, has enhanced the quality and performance of amorphous iron products. These advancements allow for the creation of materials with improved magnetic properties and reduced production costs. For instance, the introduction of high-speed quenching processes has enabled manufacturers to produce amorphous iron at a larger scale, thereby meeting the increasing market demand. Furthermore, these techniques contribute to the overall efficiency of the manufacturing process, potentially reducing waste and energy consumption. As a result, the Amorphous Iron Market is poised for growth, driven by these technological improvements that enhance product offerings and operational efficiencies.

Growing Applications in Renewable Energy

The Amorphous Iron Market is witnessing a surge in applications within the renewable energy sector. As the world shifts towards sustainable energy sources, amorphous iron is being utilized in various components of renewable energy systems, such as wind turbines and solar inverters. The unique properties of amorphous iron, including its high permeability and low core losses, make it an ideal material for enhancing the efficiency of these systems. Recent estimates suggest that the renewable energy market is expected to expand significantly, with investments in wind and solar energy projected to reach trillions of dollars in the coming years. This growth presents a substantial opportunity for the Amorphous Iron Market to capitalize on the increasing demand for efficient and reliable materials in renewable energy applications.

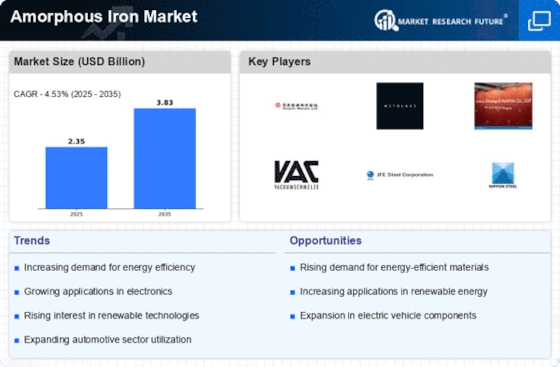

Rising Demand for Energy-Efficient Materials

The Amorphous Iron Market is experiencing a notable increase in demand for energy-efficient materials. This trend is largely driven by the growing emphasis on reducing energy consumption across various sectors, including construction and manufacturing. Amorphous iron, known for its superior magnetic properties and lower energy losses, is becoming a preferred choice for transformers and electrical devices. According to recent data, the market for energy-efficient materials is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This shift towards energy efficiency not only aligns with regulatory standards but also appeals to consumers seeking sustainable solutions. As industries strive to meet these demands, the Amorphous Iron Market is likely to see a corresponding rise in production and innovation.

Increased Investment in Electrical Infrastructure

Investment in electrical infrastructure is a critical driver for the Amorphous Iron Market. As countries modernize their power grids and expand their electrical networks, the demand for high-performance materials, such as amorphous iron, is on the rise. Amorphous iron is particularly valued for its ability to minimize energy losses in transformers and other electrical components, which is essential for maintaining efficient power distribution. Recent reports indicate that global investments in electrical infrastructure are expected to exceed several hundred billion dollars over the next decade. This influx of capital is likely to stimulate growth in the Amorphous Iron Market, as manufacturers seek to provide innovative solutions that meet the evolving needs of the electrical sector.

Regulatory Support for Energy Efficiency Standards

Regulatory frameworks promoting energy efficiency are playing a pivotal role in shaping the Amorphous Iron Market. Governments worldwide are implementing stringent energy efficiency standards aimed at reducing carbon emissions and promoting sustainable practices. These regulations often encourage the adoption of advanced materials, such as amorphous iron, which offer superior performance in energy applications. For example, policies mandating the use of energy-efficient transformers in commercial and residential buildings are driving demand for amorphous iron products. As these regulations become more prevalent, the Amorphous Iron Market is likely to benefit from increased adoption and integration of amorphous iron solutions in various applications, further solidifying its position in the market.