Rising Demand for Food Additives

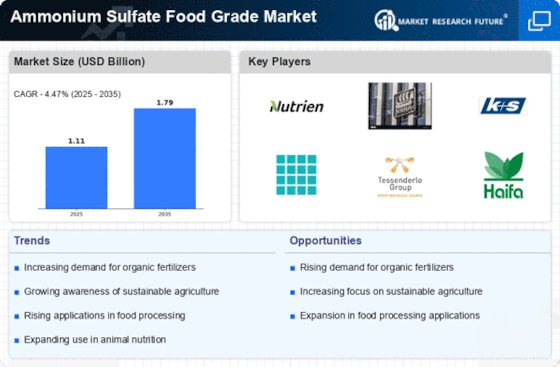

The Ammonium Sulfate Food Grade Market is experiencing a notable increase in demand for food additives, driven by the growing consumer preference for processed and convenience foods. As food manufacturers seek to enhance flavor, texture, and preservation, ammonium sulfate emerges as a viable option due to its functional properties. According to recent data, the food additives market is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This trend indicates a robust opportunity for ammonium sulfate, as it is utilized in various food products, including baked goods and dairy items. The increasing focus on food quality and safety further propels the demand for ammonium sulfate, positioning it as a key ingredient in the food industry.

Regulatory Support for Food Safety

The Ammonium Sulfate Food Grade Market is positively impacted by regulatory support for food safety. Governments and regulatory bodies are increasingly emphasizing the need for safe food additives, which has led to the establishment of stringent guidelines for food-grade chemicals. Ammonium sulfate, being recognized as safe for consumption, benefits from these regulations, as they promote its use in food applications. The regulatory landscape is evolving, with many countries adopting more comprehensive food safety standards. This environment not only reassures consumers but also encourages food manufacturers to utilize ammonium sulfate in their products. The alignment of regulatory frameworks with industry practices suggests a stable growth trajectory for ammonium sulfate in the food grade market.

Expansion of Agricultural Applications

The Ammonium Sulfate Food Grade Market is significantly influenced by the expansion of agricultural applications. Ammonium sulfate is widely recognized for its role as a nitrogen source in fertilizers, which is essential for crop growth. The increasing global population and the corresponding rise in food demand necessitate enhanced agricultural productivity. Data suggests that the fertilizer market is expected to witness a growth rate of around 4% annually, with ammonium sulfate being a preferred choice among farmers due to its effectiveness and cost-efficiency. This trend not only supports the agricultural sector but also reinforces the position of ammonium sulfate as a critical component in food production, thereby driving its demand in the food grade market.

Technological Advancements in Production

Technological advancements in the production processes of ammonium sulfate are playing a pivotal role in shaping the Ammonium Sulfate Food Grade Market. Innovations in manufacturing techniques have led to improved efficiency and reduced production costs, making ammonium sulfate more accessible to food manufacturers. Enhanced production methods, such as crystallization and granulation, ensure higher purity levels, which are crucial for food applications. As a result, the market is witnessing a shift towards higher-quality ammonium sulfate products. This trend is likely to attract more food producers, thereby expanding the market share of ammonium sulfate in the food grade sector. The continuous evolution of production technologies suggests a promising future for the industry.

Increasing Awareness of Nutritional Benefits

The Ammonium Sulfate Food Grade Market is benefiting from the increasing awareness of nutritional benefits associated with ammonium sulfate. As consumers become more health-conscious, there is a growing recognition of the importance of essential nutrients in food products. Ammonium sulfate serves as a source of sulfur, which is vital for amino acid synthesis and overall health. This awareness is driving food manufacturers to incorporate ammonium sulfate into their products to enhance nutritional profiles. Market data indicates that the health and wellness food segment is expanding rapidly, with a projected growth rate of 6% annually. This trend suggests that ammonium sulfate could play a crucial role in meeting consumer demands for healthier food options.