Market Analysis

In-depth Analysis of Aluminum Honeycomb Market Industry Landscape

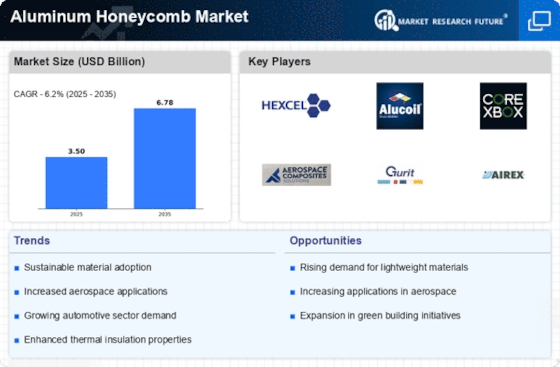

The characteristics of the Aluminum Honeycomb market give a long overview of how an important part of the materials and manufacturing industry operates, showing what else affects its production, demand and general market trends. Due to its strength, lightness and ability to retain shape aluminum honeycomb structures that have hexagonal cell design are used widely in aircraft, transportation as well as building industries. Technological advancement results into new materials, methods of producing them and their use that influences the way the Aluminum Honeycomb market works for instance. In order to keep up with technological advancements’ manufacturers invest heavily on research and development. Through this investment they make quality aluminum honeycomb products that meet varied demands of different businesses.

Global shifts in supply and demand are very influential on Aluminum Honeycombs markets. The local economy as well as global economic status has a significant impact on various sectors comprising these buildings. For example if you have a poor economy then factories can make fewer or no aluminum honeycombs which reduces their demand; however when these economies improve there is more usage than before. Moreover, also the healthiness of the market is closely associated with economic wellbeing globally because it impacts decisions concerning investments, production levels as well as pricing strategies.

The movement of the Aluminum Honeycomb market is increasingly determined by environmental factors. This is because eco-friendliness and sustainability have become central issues thus necessitating designs for honeycomb that has less effect on environment. Manufacturers are being forced to find cleaner ways to produce their goods, develop environmentally friendly types of aluminum honeycombs and look for applications in firms concerned about the environment. Hence in such a case companies having now more eco friendly metal honeycombs will be at an advantage within a marketplace where caring for nature is much more significant.

In addition trade regulations coupled with global occurrences affect immensely on Aluminum Honeycombs markets overall. Global supply chain can be influenced by taxes imposed or withdrawn from various countries all over the world since airplane and transportation manufacturing is spread across the globe. This might change the place where one can purchase metallic honeycomb structures as well as their cost in different areas. So, for example, changes in trade policy and international situation must be known by manufacturers so that they can adapt their strategies and reduce risks associated with how global market functions.

Leave a Comment