Market Trends

Key Emerging Trends in the Aluminum Clad Steel Wire Market

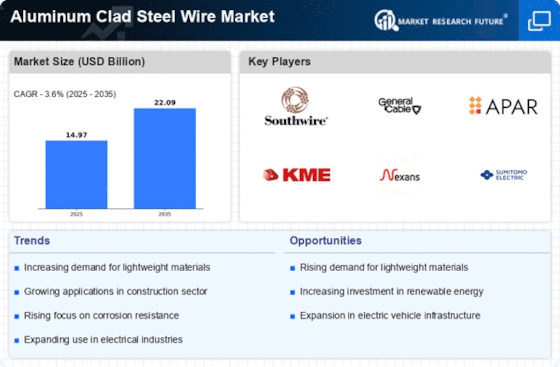

The Aluminum Clad Steel Wire market is witnessing significant growth and evolving trends driven by the expanding demand for overhead transmission and distribution lines, advancements in materials and manufacturing technologies, and the increasing focus on energy efficiency and grid reliability. Aluminum clad steel wire, also known as aluminum clad steel conductor (ACSR), is widely used in electrical transmission and distribution systems for its combination of strength, conductivity, and corrosion resistance. One notable trend in the Aluminum Clad Steel Wire market is the growing adoption of high-strength aluminum clad steel conductors for overhead power lines, particularly in regions experiencing rapid urbanization and industrialization. As demand for electricity continues to rise, there is a greater need for efficient and reliable transmission and distribution infrastructure, driving the demand for aluminum clad steel wires with higher tensile strength, reduced sag, and improved electrical conductivity.

Moreover, technological advancements in aluminum cladding and wire manufacturing processes are driving innovation in the Aluminum Clad Steel Wire market. Manufacturers are developing advanced cladding techniques, such as hot-dip aluminum coating and continuous casting processes, to improve the bonding strength and uniformity of aluminum coatings on steel wire substrates. Additionally, the use of advanced alloys and coatings enhances the corrosion resistance and durability of aluminum clad steel wires, ensuring long-term performance and reliability in harsh environmental conditions.

Another key trend in the Aluminum Clad Steel Wire market is the increasing emphasis on lightweight and high-conductivity materials for overhead transmission lines. As utilities and grid operators seek to minimize line losses, improve energy efficiency, and reduce carbon emissions, there is a growing demand for aluminum clad steel wires with higher aluminum content and improved electrical conductivity. By replacing traditional steel conductors with aluminum clad steel wires, utilities can achieve significant weight savings and reduce the overall cost of transmission line construction and maintenance.

Furthermore, the transition towards renewable energy sources such as wind and solar power is driving the demand for aluminum clad steel wires for use in overhead transmission lines and interconnections. With the expansion of wind farms and solar parks in remote and offshore locations, there is a need for transmission infrastructure capable of transmitting electricity over long distances with minimal losses. Aluminum clad steel wires offer a lightweight and cost-effective solution for building high-voltage transmission lines, enabling the efficient integration of renewable energy resources into the grid.

The Aluminum Clad Steel Wire market is also influenced by regulatory policies and government initiatives aimed at modernizing and expanding electrical infrastructure. Investments in grid modernization, smart grid technologies, and electrification projects create opportunities for aluminum clad steel wire manufacturers to supply products for transmission and distribution upgrades, grid reinforcement, and new infrastructure development. Moreover, government incentives and subsidies for renewable energy projects and transmission line construction stimulate demand for aluminum clad steel wires in the utility sector.

The COVID-19 pandemic has impacted the Aluminum Clad Steel Wire market, causing disruptions in supply chains, project timelines, and demand for electrical infrastructure products. However, the pandemic has also highlighted the importance of resilient and reliable electrical grids, driving greater investment in transmission and distribution infrastructure upgrades and modernization efforts. As economies recover and infrastructure investment resumes, the demand for aluminum clad steel wires is expected to rebound, driven by the need for efficient and sustainable solutions for powering homes, businesses, and industries.

Leave a Comment