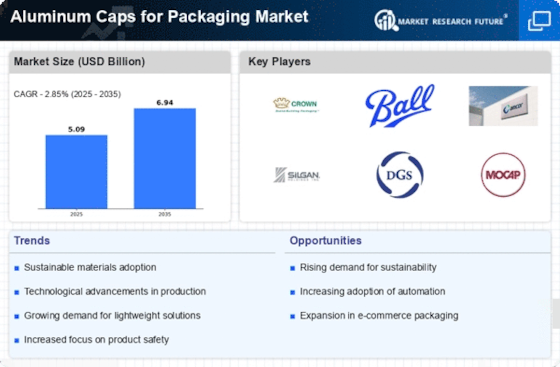

Sustainability Initiatives

The Aluminum Caps for Packaging Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, manufacturers are compelled to adopt eco-friendly practices. Aluminum, being recyclable, aligns well with these initiatives, potentially enhancing its appeal. In 2025, the demand for sustainable packaging solutions is projected to rise, with aluminum caps being a preferred choice due to their recyclability. This shift not only meets consumer expectations but also helps companies comply with stringent regulations aimed at reducing plastic waste. The emphasis on sustainability may drive innovation in the design and production of aluminum caps, further solidifying their position in the packaging market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Aluminum Caps for Packaging Market. Innovations in manufacturing processes, such as improved extrusion and stamping techniques, enhance the efficiency and quality of aluminum caps. In 2025, the market is expected to witness a surge in the adoption of automated production lines, which could lead to reduced costs and increased output. Furthermore, advancements in coating technologies may improve the aesthetic appeal and functionality of aluminum caps, making them more attractive to consumers. These technological developments are likely to create new opportunities for manufacturers, allowing them to cater to diverse market needs.

Rising Demand in Beverage Sector

The beverage sector significantly drives the Aluminum Caps for Packaging Market. With the increasing consumption of bottled beverages, including soft drinks, juices, and alcoholic drinks, the demand for reliable and effective sealing solutions is on the rise. In 2025, the beverage industry is projected to continue its growth trajectory, which may lead to a corresponding increase in the use of aluminum caps. These caps provide an airtight seal, ensuring product freshness and extending shelf life, which is crucial for beverage manufacturers. As a result, the aluminum cap market is likely to expand in tandem with the beverage sector, presenting lucrative opportunities for stakeholders.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical factors influencing the Aluminum Caps for Packaging Market. As governments implement stricter regulations regarding food and beverage packaging, manufacturers must ensure that their products meet these standards. In 2025, compliance with safety regulations is likely to become even more stringent, necessitating the use of high-quality materials like aluminum. Aluminum caps are favored for their durability and ability to maintain product integrity, making them a suitable choice for manufacturers aiming to adhere to safety guidelines. This focus on compliance may drive demand for aluminum caps, as companies prioritize packaging solutions that align with regulatory requirements.

Consumer Preference for Lightweight Packaging

Consumer preference for lightweight packaging is a notable driver in the Aluminum Caps for Packaging Market. As manufacturers seek to reduce shipping costs and improve sustainability, lightweight materials like aluminum are gaining traction. In 2025, the trend towards lightweight packaging is expected to continue, as it not only lowers transportation expenses but also minimizes environmental impact. Aluminum caps, being lighter than many alternatives, offer a practical solution for companies aiming to enhance their packaging efficiency. This shift in consumer preference may encourage manufacturers to innovate and develop even lighter aluminum cap designs, further solidifying their market position.