Top Industry Leaders in the Alloys for Automotive Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Alloys for Automotive industry are:

ArcelorMittal SA (Luxembourg)

Aditya Birla Group (India)

Alcoa Inc. (U.S.)

UACJ Corporation (Japan)

ThyssenKrupp AG (Germany)

Kobe Steel Ltd. (Japan)

Norsk Hydro ASA (Norway)

AMG Advanced Metallurgical Group NV (Netherlands)

Constellium (Netherlands)

AGCO Corporation (U.S)

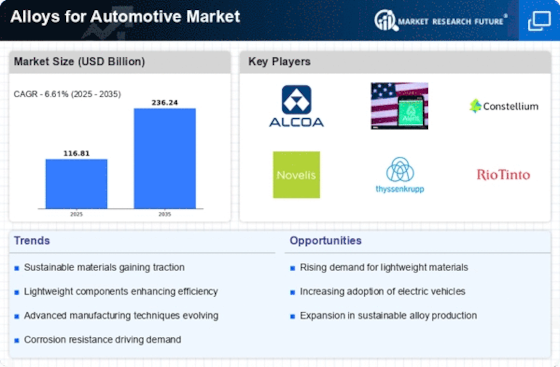

Competitive Landscape of Alloys for the Automotive Market: A Strategic Analysis

The automotive market is at a pivotal point, driven by factors like rising fuel costs, stringent emission regulations, and the burgeoning electric vehicle (EV) segment. In this evolving landscape, alloys are playing a crucial role, influencing vehicle performance, efficiency, and aesthetics. Understanding the competitive landscape of alloys within the automotive market is key for industry players and investors alike.

Key Players and Strategies:

Aluminum Giants: Norsk Hydro, Alcoa, and Constellium lead the pack with established capacities, research & development (R&D) prowess, and global reach. Their strategies focus on lightweighting solutions, high-performance alloys for EVs, and sustainability initiatives like closed-loop recycling.

Tier 1 Suppliers: Companies like Magna and Adient play a crucial role in developing and integrating alloy components into vehicles. Their strategies involve collaborations with automakers, expanding into adjacent markets like EVs, and investing in advanced manufacturing technologies.

Emerging Players: Startups and smaller firms are entering the fray with innovative, niche offerings. This includes alloys with enhanced strength-to-weight ratios, corrosion resistance, and recyclability. Their strategies revolve in disrupting established players with agile manufacturing, targeted partnerships, and differentiated product offerings.

Market Share Analysis Factors:

Material type: Aluminum dominates the market due to its lightweighting potential, but advanced high-strength steels and magnesium alloys are gaining traction. Market share will depend on factors like cost, performance, and integration with specific vehicle components.

Application segment: Body panels, chassis, wheels, and engine components each have different alloy requirements. Players that cater to specific segments effectively will hold an advantage.

Sustainability: The industry is under pressure to reduce its carbon footprint. Players with energy-efficient production processes, closed-loop recycling, and low-carbon alloys will have a competitive edge.

Regional considerations: Market dynamics vary across regions. Emerging markets like China and India have high growth potential, but demand different alloy solutions compared to established markets.

New and Emerging Trends:

3D printing: This technology opens up possibilities for customized alloy components with complex geometries, potentially changing the manufacturing landscape.

Additive manufacturing: Combining 3D printing with advanced materials like metal matrix composites promises lighter, stronger components for high-performance applications.

Bio-based alloys: Research on utilizing bio-sourced materials like plant fibers in alloys could lead to more sustainable and lightweight alternatives.

Artificial intelligence (AI)-driven design: AI can be used to optimize alloy composition, predict performance, and accelerate the development of new alloys tailored for specific applications.

Competitive Scenario:

The automotive alloy market is dynamic and fiercely competitive. Established players face the challenge of maintaining their market share while adapting to new technologies and regulations. Emerging players have the opportunity to disrupt the market with innovative offerings, but need to scale their operations effectively. Collaboration, strategic partnerships, and continuous innovation will be key for all players to thrive in this evolving landscape.

Overall, the competition in the automotive alloy market is driven by a complex interplay of factors, including material type, application segment, sustainability considerations, and regional variations. The emergence of new technologies and trends further adds to the dynamism of this sector. Understanding these dynamics and adapting to the changing landscape will be crucial for both established and emerging players to secure their position in the future of automotive alloys.

This analysis provides a starting point for understanding the competitive landscape of alloys in the automotive market. Further research and analysis could delve deeper into specific segments, player profiles, and future growth projections for a more comprehensive picture.

Latest Company Updates:

ArcelorMittal SA (Luxembourg):

- Date: October 26, 2023 (Source: ArcelorMittal press release)

- Development: Launched XCarb® Sustain, a range of low-carbon footprint steel and automotive sheet products made with increased recycled content and innovative production processes.

Alcoa Inc. (U.S.):

- Date: November 09, 2023 (Source: Alcoa press release)

- Development: Unveiled a new high-strength aluminum alloy specifically designed for battery enclosures in electric vehicles.

UACJ Corporation (Japan):

- Date: October 25, 2023 (Source: Nikkei Asian Review)

- Development: Partnering with Toyota to develop high-performance magnesium alloys for lightweight car parts.

ThyssenKrupp AG (Germany):

- Date: September 28, 2023 (Source: ThyssenKrupp press release)

- Development: Investing in a new production line for high-strength steel for automotive applications, focusing on crash safety and weight reduction.