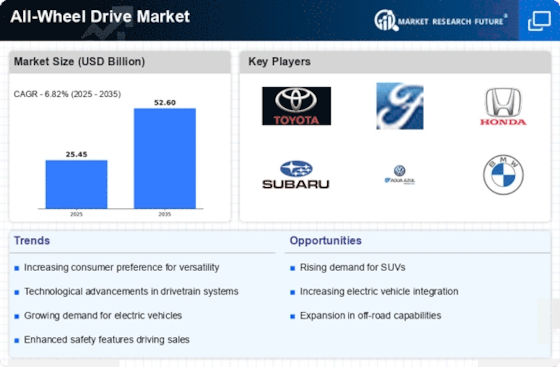

Top Industry Leaders in the All-Wheel Drive Market

*Disclaimer: List of key companies in no particular order

All-Wheel Drive Market Latest Company Updates:

October 2023- Chevrolet will begin taking orders for the Equinox EV in the US in the first week of November. Introduced last year, the electric compact SUV will initially be available at prices starting at USD48,995 with front-wheel drive or USD52,395 with all-wheel drive. The Equinox EV was introduced about a year ago and is one of the smallest models to date based on the Ultium platform of the parent company, General Motors. The compact SUV is built at GM's Ramos Arizpe plant in Mexico. The front-wheel drive produces 157 kW, and the all-wheel drive model is rated at 216 kW. Deliveries of these two variants are scheduled to begin in early 2024. The base model, originally announced for around USD30,000, will cost USD34,995 and is not scheduled for delivery until late 2024. According to GM, there will be around 200,000 expressions of interest in the model even before orders start. Which variant these potential customers are interested in and whether they will still order a vehicle with the now somewhat higher prices is an open question.

On the other hand, the range is somewhat higher than promised at the premiere in September 2022. At that time, a range of 250 to 300 miles (400 to 480km) was given, depending on the version. Now Scott Bell, vice president for Global Chevrolet, said the front-wheel-drive variant had been certified at 319 miles in EPA testing, the equivalent of 513 kilometers. The four-wheel-drive version is not yet EPA-certified, but GM now expects a range of 280 miles (450 kilometers).

Top listed global companies in the industry are:

- GKN PLC (UK)

- American Axle & Manufacturing Inc. (US)

- Magna International Inc. (Canada)

- BorgWarner Inc. (US)

- ZF Friedrichshafen AG (Germany)

- Continental AG (Germany)

- Dana Limited (US)

- JTEKT Corporation (Japan)

- Oerlikon (Italy)

- Eaton (Ireland), and others.