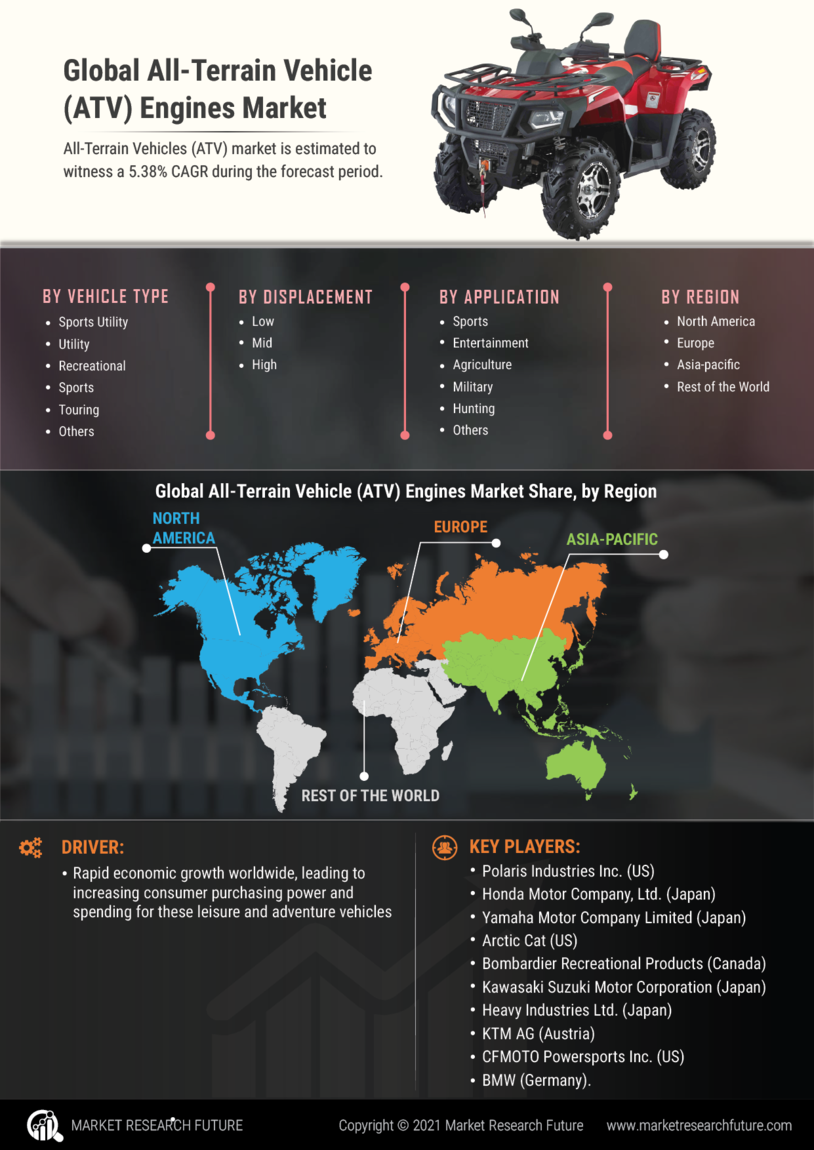

Expansion of ATV Applications

The All-Terrain Vehicle (ATV) Engines Market is experiencing an expansion in the applications of ATVs beyond traditional recreational use. Industries such as agriculture, forestry, and construction are increasingly adopting ATVs for their versatility and efficiency in navigating rugged terrains. This diversification of applications is driving demand for specialized ATV engines that can cater to specific industry needs. Market data suggests that the industrial segment of the ATV market is expected to grow at a CAGR of 6% over the next five years, indicating a robust opportunity for manufacturers to develop engines tailored for various professional applications. This trend not only broadens the market scope but also enhances the overall growth potential of the ATV engines market.

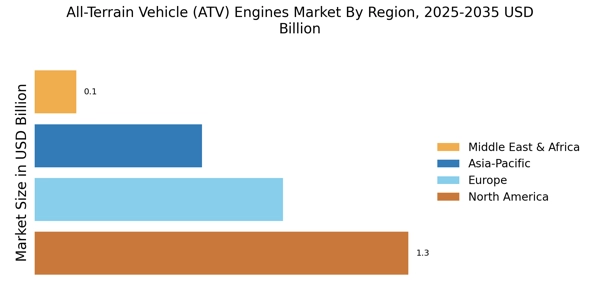

Government Initiatives and Support

Government initiatives aimed at promoting outdoor activities and tourism are playing a pivotal role in the All-Terrain Vehicle (ATV) Engines Market. Various countries are implementing policies that encourage the use of ATVs for recreational purposes, including the development of designated trails and parks. These initiatives not only enhance accessibility for ATV users but also stimulate market growth by increasing the number of potential customers. Furthermore, financial incentives and subsidies for ATV purchases are being introduced in some regions, further driving demand. As a result, the market is likely to see a positive impact from these supportive measures, fostering a conducive environment for ATV engine manufacturers.

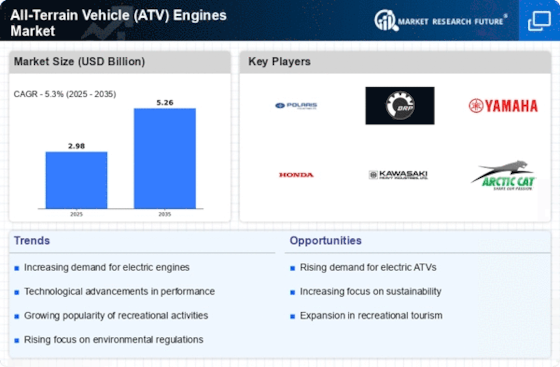

Growing Demand for Electric ATV Engines

The All-Terrain Vehicle (ATV) Engines Market is witnessing a notable shift towards electric ATV engines, driven by increasing environmental awareness and the push for sustainable transportation solutions. Consumers are becoming more conscious of their carbon footprint, leading to a rising demand for electric alternatives that offer lower emissions and quieter operation. Market analysts project that the electric ATV segment could account for a significant portion of the overall ATV engines market by 2030, potentially reaching a market share of 25%. This transition towards electric engines not only aligns with The All-Terrain Vehicle (ATV) Engines segment.

Technological Innovations in ATV Engines

The All-Terrain Vehicle (ATV) Engines Market is experiencing a surge in technological innovations, particularly in engine design and performance. Manufacturers are increasingly integrating advanced technologies such as fuel injection systems, turbocharging, and electronic control units to enhance engine efficiency and power output. These innovations not only improve the overall performance of ATVs but also contribute to reduced emissions, aligning with stricter environmental regulations. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 5% over the next few years. This trend indicates a strong consumer preference for high-performance, technologically advanced ATV engines.

Rising Popularity of Outdoor Recreational Activities

The All-Terrain Vehicle (ATV) Engines Market is benefiting from the increasing popularity of outdoor recreational activities. As more individuals seek adventure and leisure in natural settings, the demand for ATVs has escalated. This trend is particularly evident in regions with vast landscapes, where ATVs serve as a preferred mode of transportation for recreational purposes. Market data indicates that the sales of ATVs have risen by approximately 10% annually, driven by a growing consumer base that values outdoor experiences. Consequently, this surge in demand for ATVs directly influences the growth of the ATV engines market, as manufacturers strive to meet the needs of an expanding customer segment.