Market Growth Projections

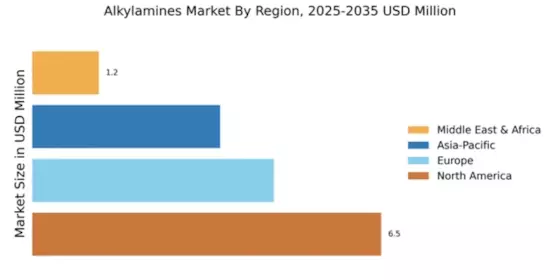

The Global Alkylamines Market Industry is characterized by robust growth projections, with anticipated market values reaching 7.08 USD Billion in 2024 and 12.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.38% from 2025 to 2035. Such figures indicate a strong demand across various sectors, including agriculture, pharmaceuticals, and personal care. The increasing applications of alkylamines in diverse industries reflect their versatility and importance in modern manufacturing processes.

Growing Demand from Agrochemicals

The Global Alkylamines Market Industry experiences a notable surge in demand driven by the agrochemical sector. Alkylamines Market serve as key intermediates in the production of herbicides, pesticides, and fungicides. As agricultural practices evolve, the need for effective crop protection solutions intensifies. For instance, the increasing focus on sustainable farming methods and the adoption of precision agriculture techniques contribute to the rising consumption of alkylamines. This trend is expected to bolster the market, with projections indicating a market size of 7.08 USD Billion in 2024, reflecting the critical role of alkylamines in enhancing agricultural productivity.

Increasing Use in Personal Care Products

The Global Alkylamines Market Industry is witnessing a rise in the utilization of alkylamines in personal care and cosmetic formulations. These compounds are valued for their surfactant properties, which enhance the performance of shampoos, conditioners, and skin care products. The growing consumer preference for high-quality personal care items, coupled with the trend towards natural and organic ingredients, drives the demand for alkylamines. As manufacturers seek to innovate and improve product efficacy, the market is poised for growth, potentially aligning with the broader trends in consumer behavior and product development.

Expanding Applications in Pharmaceuticals

The Global Alkylamines Market Industry is significantly influenced by the pharmaceutical sector, where alkylamines are utilized in the synthesis of various active pharmaceutical ingredients. Their versatility allows for the development of a wide range of medications, including analgesics and anesthetics. The ongoing research and development efforts in the pharmaceutical industry are likely to propel the demand for alkylamines, as new drug formulations emerge. As the global healthcare landscape evolves, the market is projected to grow, reaching an estimated 12.6 USD Billion by 2035, underscoring the importance of alkylamines in modern medicine.

Rising Demand for Water Treatment Solutions

The Global Alkylamines Market Industry benefits from the increasing need for effective water treatment solutions. Alkylamines Market are employed in the production of water treatment chemicals, which are essential for maintaining water quality in industrial and municipal applications. As global water scarcity issues become more pressing, the demand for efficient water treatment processes is likely to escalate. This trend is further supported by regulatory frameworks aimed at improving water quality standards. Consequently, the market for alkylamines is expected to expand, reflecting the growing emphasis on sustainable water management practices.

Technological Advancements in Production Processes

The Global Alkylamines Market Industry is influenced by ongoing technological advancements in the production of alkylamines. Innovations in manufacturing processes enhance efficiency, reduce costs, and minimize environmental impact. For instance, the adoption of greener synthesis methods and improved catalysts can lead to higher yields and lower energy consumption. These advancements not only support the economic viability of alkylamines but also align with global sustainability goals. As the industry adapts to these changes, it is likely to experience robust growth, with a projected CAGR of 5.38% from 2025 to 2035.