Airport Operations Market Summary

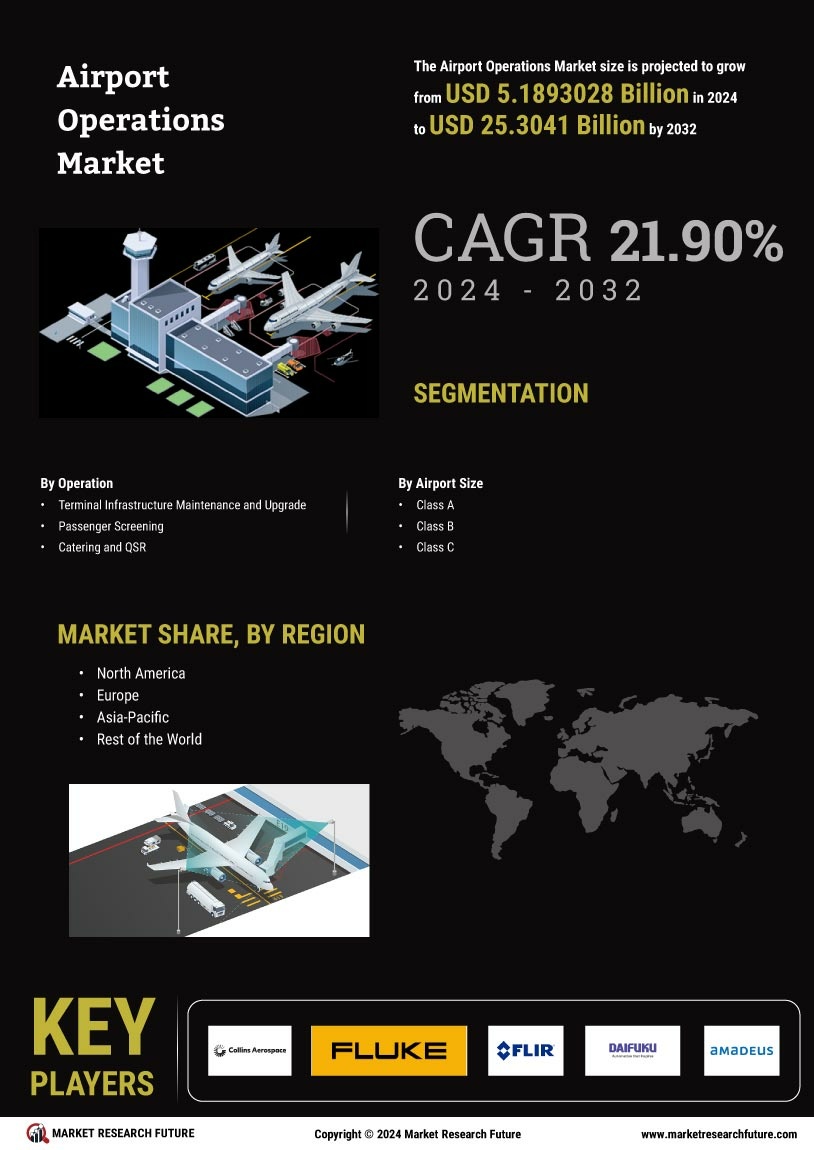

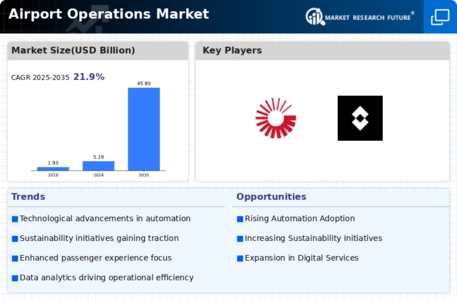

As per Market Research Future Analysis, the Airport Operations Market is poised for significant growth, expanding from USD 5.19 Billion in 2024 to USD 45.84 Billion by 2035, with a CAGR of 21.90% during the forecast period. The market was valued at USD 5.19 Billion in 2024, driven by increasing global passenger traffic and the demand for real-time information. Key operational segments include airside, landside, and financial operations, with a notable focus on baggage screening due to rising security concerns and passenger volume. The integration of total airport management systems is expected to enhance operational efficiency and decision-making across various stakeholders.

Key Market Trends & Highlights

The Airport Operations Market is witnessing transformative trends driven by technological advancements and increasing air travel.

- Market size projected to grow from USD 5.19 Billion in 2024 to USD 25.30 Billion by 2032.

- Baggage screening segment dominates due to rising air passenger traffic and security threats.

- Asia-Pacific expected to grow at the fastest CAGR from 2023 to 2032, with China planning to build 220 additional airports.

- North America holds the largest market share, driven by increased air travel and economic growth.

Market Size & Forecast

| 2024 Market Size | USD 5.19 Billion |

| 2035 Market Size | USD 45.84 Billion |

| CAGR | 21.90% |

Major Players

Key players include Collins Aerospace (US), FLIR Systems Inc. (US), Fluke Corporation (US), Daifuku Co. Ltd. (Japan), and Amadeus IT Group SA (Spain).