Airport Iot Size

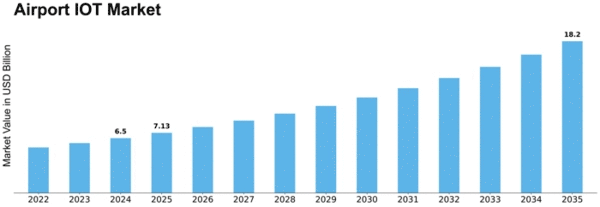

Airport IOT Market Growth Projections and Opportunities

The Airport Internet of Things (IoT) sector is driven by technical advances, aviation industry digitization, and a focus on airport operational efficiency and passenger experience. Integration of IoT technology to enhance airport operations is a major driver. Airports may gather and analyze real-time data by implementing connected sensors, devices, and systems in baggage handling, security, and maintenance. This data-driven strategy improves airport efficiency by streamlining operations and improving decision-making.

Airport IoT market dynamics are driven by IoT device and connection innovations. As sensors, communication protocols, and edge computing improve, airports may deploy several IoT applications. These technologies allow airports to establish networked systems that give useful insights, improving safety, security, and resource management by tracking luggage and aircraft maintenance.

Demand for better passenger experiences drives Airport IoT market dynamics. Airports are using IoT to speed up and customize passenger experiences. This includes smart check-in, real-time updates, and passenger-specific services. IoT technology in passenger-centric services improve airport efficiency and customer happiness, increasing loyalty.

Airport IoT adoption is driven by security concerns, affecting market dynamics. IoT-enabled surveillance, biometric authentication, and access control improve airport security. Airports can swiftly respond to threats and maintain passenger, crew, and asset safety by monitoring and analyzing security-related IoT device data in real time. Security concerns and the requirement for strong threat detection drive airport IoT application growth.

The regulatory environment also shapes Airport IoT market dynamics. Airports must follow strict safety, security, and efficiency regulations. As airports develop and implement IoT technology, regulatory compliance becomes increasingly important. Manufacturers and service providers building IoT solutions that fulfill industry standards and increasing regulatory frameworks affect market dynamics.

Airport budgets and financing affect Airport IoT market dynamics. Airports' IoT investments and deployment depend on their finances. Airports prioritize solutions with a high return on investment and integrate their IoT adoption strategy with financial limits. Airports and technology suppliers must consider IoT solution pricing and cost-effectiveness.

The Airport IoT industry is driven by airport-technology vendor alliances and ecosystems. Airports work with technology suppliers, system integrators, and IoT solution developers to customize IoT apps. This collaborative strategy accelerates IoT adoption, stimulates creativity, and develops comprehensive and interoperable solutions to airport concerns.

Airport IoT markets are increasingly considering sustainability. Airports are investigating IoT applications to improve energy efficiency, resource consumption, and waste reduction as the aviation sector reduces its environmental impact. Sustainable market dynamics entail the development of IoT solutions that help airports meet environmental goals, aligning with industry trends toward eco-friendly and sustainable activities.

Leave a Comment