Enhanced Customer Experience

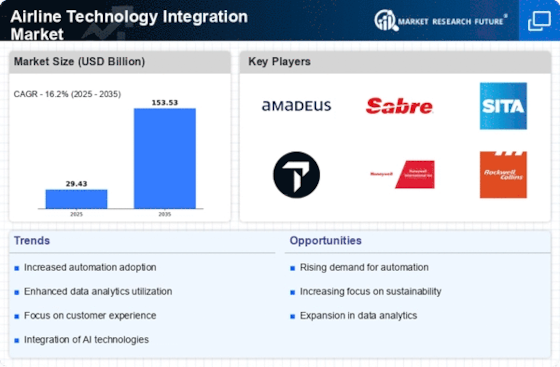

The airline technology integration Market is increasingly driven by the need to enhance customer experience. Airlines are integrating advanced technologies such as artificial intelligence and machine learning to personalize services and streamline operations. This integration allows for real-time data analysis, enabling airlines to anticipate customer needs and preferences. According to recent data, airlines that have adopted these technologies report a 20% increase in customer satisfaction scores. Furthermore, the integration of mobile applications and self-service kiosks has transformed the passenger journey, making it more efficient and user-friendly. As competition intensifies, airlines recognize that a superior customer experience is not just a differentiator but a necessity for retaining loyalty in the Airline Technology Integration Market.

Growing Demand for Sustainability

The growing demand for sustainability is increasingly shaping the Airline Technology Integration Market. Airlines are under pressure to reduce their carbon footprint and implement eco-friendly practices. This has led to the integration of technologies that promote fuel efficiency and reduce emissions. For example, the adoption of advanced flight planning software can optimize routes to minimize fuel consumption. Additionally, airlines are exploring sustainable aviation fuels and electric aircraft as part of their long-term strategies. The integration of these sustainable technologies not only addresses environmental concerns but also aligns with consumer preferences for greener travel options. As sustainability becomes a core focus, it is likely to drive innovation and investment in the Airline Technology Integration Market.

Emergence of Innovative Technologies

The emergence of innovative technologies is a key driver in the Airline Technology Integration Market. Technologies such as blockchain, Internet of Things (IoT), and augmented reality are being explored for their potential to revolutionize airline operations. For instance, blockchain can enhance transparency in ticketing and baggage handling, while IoT devices can provide real-time monitoring of aircraft systems. The integration of these technologies is expected to create new revenue streams and improve operational resilience. As airlines seek to differentiate themselves in a competitive landscape, the adoption of innovative technologies becomes essential. This trend indicates a shift towards a more interconnected and technologically advanced Airline Technology Integration Market.

Operational Efficiency and Cost Reduction

Operational efficiency remains a pivotal driver in the Airline Technology Integration Market. Airlines are increasingly adopting integrated systems that streamline operations, reduce redundancies, and enhance productivity. For instance, the implementation of automated scheduling and maintenance systems has been shown to decrease operational costs by up to 15%. Additionally, the integration of data analytics allows airlines to optimize fuel consumption and improve route planning, further contributing to cost savings. As airlines face pressure to maintain profitability, the focus on operational efficiency through technology integration becomes paramount. This trend not only supports financial sustainability but also positions airlines competitively within the Airline Technology Integration Market.

Regulatory Compliance and Safety Standards

The Airline Technology Integration Market is significantly influenced by the need for regulatory compliance and adherence to safety standards. Governments and aviation authorities worldwide impose stringent regulations to ensure passenger safety and operational integrity. As a result, airlines are compelled to integrate advanced technologies that facilitate compliance with these regulations. For example, the use of integrated safety management systems helps airlines monitor and report safety metrics effectively. Moreover, the integration of real-time data tracking systems enhances incident response capabilities, thereby improving overall safety. This focus on compliance not only mitigates risks but also fosters trust among passengers, which is crucial in the Airline Technology Integration Market.