Increased Aircraft Production

The Aircraft Struts And Rod Market is experiencing a surge in demand due to the rising production rates of commercial and military aircraft. As manufacturers ramp up their output to meet the growing need for air travel and defense capabilities, the requirement for high-quality struts and rods becomes paramount. In 2025, the total aircraft production is projected to reach approximately 1,500 units, which indicates a robust growth trajectory. This increase in production not only drives the demand for struts and rods but also encourages innovation in materials and design, enhancing the overall performance and safety of aircraft. Consequently, suppliers in the Aircraft Struts And Rod Market are likely to invest in advanced manufacturing techniques to cater to this escalating demand.

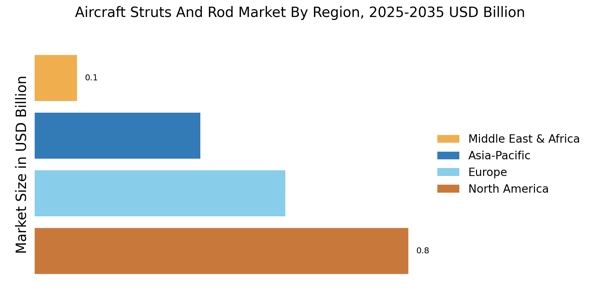

Emerging Markets and Regional Expansion

The Aircraft Struts And Rod Market is witnessing a shift as emerging markets expand their aviation sectors. Countries in Asia-Pacific, the Middle East, and Africa are investing heavily in their aviation infrastructure, leading to an increase in aircraft orders and, subsequently, the demand for struts and rods. In 2025, it is estimated that these regions will account for over 30% of new aircraft deliveries, highlighting the potential for growth in the Aircraft Struts And Rod Market. This regional expansion not only opens new avenues for suppliers but also encourages competition and innovation as companies strive to meet the diverse needs of these markets. As a result, the Aircraft Struts And Rod Market is likely to experience a dynamic shift in its competitive landscape.

Regulatory Compliance and Safety Standards

The Aircraft Struts And Rod Market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations necessitate the use of high-quality materials and components in aircraft manufacturing, thereby driving the demand for reliable struts and rods. In 2025, it is anticipated that regulatory bodies will continue to enforce rigorous testing and certification processes, compelling manufacturers to prioritize safety and reliability in their designs. This focus on compliance not only enhances the safety of air travel but also fosters innovation within the Aircraft Struts And Rod Market, as companies strive to meet or exceed these standards. As a result, the market is likely to witness an uptick in the adoption of advanced materials and technologies.

Technological Innovations in Materials and Design

The Aircraft Struts And Rod Market is being transformed by technological innovations in materials and design. Advances in composite materials and manufacturing techniques are enabling the production of lighter, stronger, and more durable struts and rods. In 2025, it is projected that the adoption of advanced composites will increase by 25%, reflecting a growing trend towards enhancing aircraft performance and fuel efficiency. These innovations not only improve the overall safety and reliability of aircraft but also contribute to cost savings for operators. As manufacturers in the Aircraft Struts And Rod Market embrace these technological advancements, they are likely to gain a competitive edge, positioning themselves favorably in a rapidly evolving market.

Growth in Aerospace Maintenance, Repair, and Overhaul (MRO) Services

The Aircraft Struts And Rod Market is poised for growth due to the expanding aerospace maintenance, repair, and overhaul (MRO) services sector. As the global fleet of aircraft ages, the need for regular maintenance and replacement of critical components, including struts and rods, becomes increasingly vital. In 2025, the MRO market is projected to reach USD 100 billion, indicating a substantial opportunity for suppliers of struts and rods. This growth is driven by the necessity to ensure aircraft safety and operational efficiency, prompting airlines and operators to invest in high-quality replacement parts. Consequently, the Aircraft Struts And Rod Market stands to benefit from this trend, as MRO providers seek reliable and durable components to meet the demands of their clients.