Aircraft Sensors Size

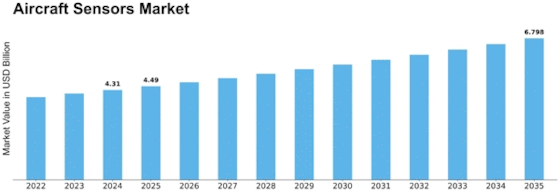

Aircraft Sensors Market Growth Projections and Opportunities

Dynamic and transformative market dynamics have characterized the Aircraft Sensors Market, which is driven by an evolving technological landscape and the aviation industry’s increasing reliance on advanced sensor technologies. In this regard, one essential factor that shapes this market is a constant quest for safety and efficiency in aviation operations. For instance, aircraft sensors are key providers of real-time data concerning different parameters such as altitude, speed, temperature and pressure thereby improving situational awareness and ensuring aircraft operate safety and efficiently. Advanced sensor technologies are required as the industry seeks to develop easy-to-use devices in support of its commitment to overall air travel security.

The dynamics in the Aircraft Sensors Market are driven by innovation and technological advancements at the core. Sensor capabilities keep on being improved in the aviation sector with introduction of innovations like smart sensors, MEMS (Micro-Electro-Mechanical Systems) technology as well as advanced materials. These innovations enhance accuracy, reliability and miniaturization of sensors that meet industry needs for lightweight/high-performance solutions. The dynamic nature of technological advances reflects the industries’ determination to be at par with new developments in sensor technology used within modern day air travel.

Another major market dynamic is increased focus on environmental sustainability. As part of efforts to reduce its environmental footprint, the aviation industry utilizes these tools to optimize fuel efficiency thereby minimizing emissions from aircrafts. These include fuel management sensors, engine performance sensors and aerodynamic sensors all aimed at developing more fuel efficient airplanes.Sustainability-oriented demand for these types of avionics highlights how much weight has been given to environmental issues globally.

Aircraft Sensors Market is undergoing transformation through digitization and connectivity growth trends.Accordingly ,sensors play a vital role in gathering accurate information necessary for real time monitoring processes.The development of smart systems relies heavily on aircraft sensors that enable communication between different onboard components with those based on ground approaches.The above trend indicates how much aviation believes that decisions made based on data can improve operational efficiencies by using information readily available to them.

Globalization and the increase in air travel contribute to the expansion of the Aircraft Sensors Market. Through this boom, aircraft sensors have become crucial in managing complexities associated with global air transport within aviation industry. They help optimize navigation, traffic management and communication systems for safe and efficient movement of aircraft in congested airspace.Simultaneously growing demand for sensors that support globalization in air travel underpins the need for airlines to respond to challenges emanating from a more integrated aviation ecosystem.

Regulatory requirements and safety standards represent constant and pivotal market dynamics within the Aircraft Sensors Market. Because of such a stringent regulatory framework under which aviation operates, sensors that are installed must conform to strict safety and performance specifications.Through adherence to these regulations, sensors ensure that aircraft are able to meet all the prescribed conditions of being safe. Globally, this is also seen as a dynamic because it symbolizes how high standards must be maintained within this specific field of production through regulatory compliance. technologically advanced solutions that cater to the evolving needs of the aviation industry, ensuring safer, more efficient, and environmentally sustainable air travel.”

Leave a Comment